These dubious organizations you are going to state they cure bad details on the credit history right away

Along with paying promptly and you can cutting your bills, definitely look at your credit report. New Federal Trading Commission (FTC) cards one around 20% of all of the credit file possess wrong guidance. It is an incorrect target or a documented fee into the a bad membership. It does tend to be sharing investigation which have some body away from a comparable name, if not a wrong Societal Safeguards count. According to the quantity of one’s error, not the right advice may actually decrease your credit history.

You could demand a duplicate of the credit history within AnnualCreditReport. People are entitled to a totally free credit report most of the 12 months. If you find any completely wrong information about their file, you should argument this new error towards the credit scoring institution. Give an explanation for mistake thru authoritative page, and you will attach data files who would support the claim. To understand about how to argument credit history problems, visit the Individual Funds Coverage Agency (CFPB) web page.

Throughout the bankruptcy proceeding otherwise foreclosures, you could see borrowing from the bank repair systems which promise to evolve your credit rating. They could actually bring to increase your credit score by accompanying your credit report that have another type of consumer who may have a borrowing score. So it practice, named piggybacking,’ is illegal when done rather than a legitimate reference to a beneficial consumer. It is reasonably sensed scam for many who purposely do it so you can misguide banks and other lending organizations.

The only method you could potentially improve your credit rating will be to perform the functions. Create payments promptly and relieve your financial situation. The reality is there is absolutely no quick answer to develop your own borrowing. To avoid then items, it is best to avoid borrowing resolve cons.

From the core away from improving your credit rating is an excellent debt payment method. At this point, you really need to certainly initiate organizing your finances. This could voice daunting, particularly if you aren’t regularly economic considered or form costs. Others also are unmotivated into potential for calculations and you will reducing down expenditures. However, let me reveal a better way in order to reframe their direction: Cost management is lifestyle in your mode when you are having the ability to pay for the wants.

Budgeting try a method of cutting your costs if you’re boosting your earnings. This begins with and also make a summary of very important time-today expenses, and you will segregating all of them from low-very important discretionary can cost you. Usually of thumb, you ought to always prioritizes essential instructions more items that are fantastic to have, but not required. Important expenses incorporate eating, tools, book, transport, and you may first will cost you you would like to have everyday living. Non-requirements safeguards many techniques from nice clothes, sneakers, dining out, passion, travel, an such like.

This new FTC claims one up to 5% off users have credit report mistakes that may bring about undesirable financing income

Assess your own monthly earnings. Checklist off simply how much you spend a month. After that, factor in how much obligations you pay and include you to definitely on your crucial expenses. Once you make your checklist, you will have a pretty good tip exactly what products your constantly expend on, and and that costs you could desired. From that point, you could potentially to switch your budget and come up with area to own financial obligation costs and you can offers.

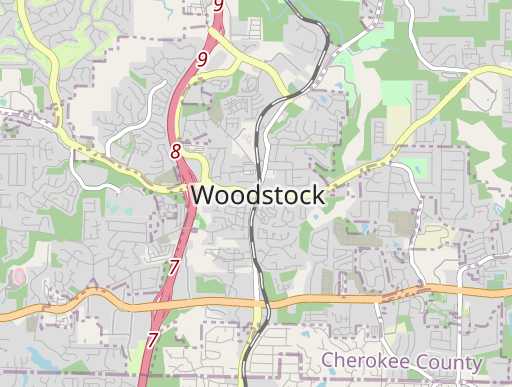

Cut down on unnecessary costs such dining out, specific hobbies, or to acquire this new clothes. Many people along with love to book at reasonable where you can maximize the discounts. When you need to clean out transportation costs, it is possible to take public transit for those who have an obtainable bus or train route near you. In the end, if you intend to invest in property soon, definitely cover offers to get adequate deposit.