Newrez, earlier called The Penn Economic, is actually a domestic mortgage company situated in Fort Arizona, Pennsylvania. Subscribed so you can originate mortgage loans nationwide, the business offers several different mortgage things. These include one another fixed-rate and you may adjustable-rate mortgages, as well as FHA, Virtual assistant, USDA, refinancing and you will investment property finance. This allows customers to determine exactly what brand of loan really works good for her or him regarding one bank.

Newrez are a totally on the web home loan company. This means that you simply will not be able to availableness people branches or other actual where you can correspond with a good Newrez home loan member truly. Yet not, the business keeps an effective website that offers meanings of the many their funds, hand calculators and you will educational tips. You might not be able to supply pricing in place of entering your information, though.

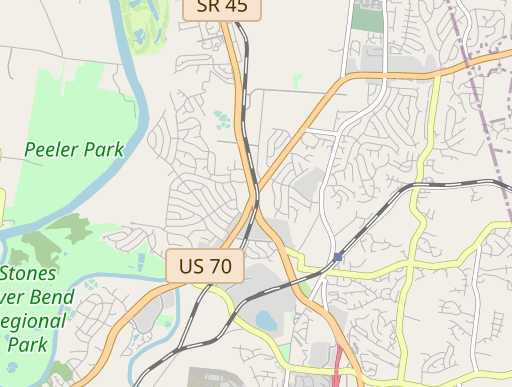

Does Newrez Work with My Town?

As a nationwide mortgage lender, Newrez is actually signed up to do business in every fifty states, such as the District from Columbia. Once again, the firm cannot work any twigs.

Fixed-rates mortgage loans: The best brand of mortgage, a fixed-rate mortgage have an appartment interest on the longevity of the loan. Mortgage words within Newrez can vary out of ten so you can 3 decades.

Adjustable-rates mortgages: Also referred to as Possession, adjustable-speed mortgage loans start with a fixed rates just before becoming familiar with sector pricing once a flat period. Such attacks always last about three so you can 7 years, which have rates modifying generally on the an annual foundation later.

FHA finance: Covered from the Federal Homes Management (FHA), such unique mortgage loans wanted a minimum step 3.5% downpayment and may become more accessible to borrowers having prior borrowing from the bank points.

Va funds: Backed by new Service away from Veteran Affairs (VA), such financing are designed to aid licensed army professionals, veterans, and reservists purchase land. Even though consumers must pay a great Va money percentage, usually banking institutions do not require a down-payment for this method of from financing that will promote less interest rate than just that have a normal financing product.

USDA financing: Given simply when you look at the appointed rural areas, the fresh Service off Agriculture (USDA) provides these money to keep and you will renew much more outlying components of the nation. Unique terms could be considering, including 100% resource and higher freedom having borrowers having straight down otherwise poorer borrowing from the bank results.

Exactly what do You will do Online That have Newrez?

Before applying to have a mortgage at Newrez, their webpages also provides numerous calculators to imagine your monthly payments. Their home loan calculator helps you break apart potential mortgage payments for simple information, together with refinancing calculator is also demonstrated just how much you might save yourself having good refinanced home loan from the a lower interest rate. Newrez now offers a helpful calculator on the best way to photo costs out-of renting instead of to invest in, and a good calculator in order to guess new influences of different mortgage words and you will wide variety.

You could potentially incorporate actually to have a mortgage on the web having Newrez. The applying techniques is easy and simple, you have the choice off getting in touch with to speak with good loan officer if you want.

You may take control of your mortgage from Newrez mobile app. Potential borrowers can publish all the files expected to the brand new app, track its applications and soon after do payments from their mobile phones. Yet not, the fresh new Newrez app keeps fared badly when it comes to member evaluations, plus it appears to have only very first effectiveness. With the Fruit app store, profiles possess ranked brand new app at dos famous people off 5, if you find yourself Android os pages keeps ranked it simply a bit most readily useful in the 2.dos famous people out-of 5.

Might you Qualify for home financing Off Newrez?

Extremely loan providers ask for a good FICO rating with a minimum of 620 to possess a normal loan, while particular authorities-recognized software support individuals with quicker-than-reasonable credit. Newrez is not any exclusion. Other variables that loan providers like Newrez think become the debt-to-money (DTI) ratio in addition to cost of wished household. Typically, good DTI ratio regarding 43% or faster is preferred of the lenders.

Of a lot government-supported mortgages will additionally require the borrower to invest a private financial superior (PMI), once the tend to antique loans having down repayments of less than 20%. According to the mortgage product, particular accredited customers will most likely not need to set any money off whatsoever.

What’s the Techniques for https://elitecashadvance.com/installment-loans-ms/blue-springs/ finding a mortgage Having Newrez?

You can begin the procedure from the filling in a home loan application online from the company’s websitepleting the applying often guide you by way of an assessment out of loan alternatives therefore the criteria must disperse the application give. With respect to the Newrez website, the newest prequalification processes is simple, as well as the case with many on the web loan providers. not, you always have the option out of talking to loan administrator more than the phone.

A specialist will appraise your property once your software might have been obtained and your render acknowledged. As soon as your mortgage could have been processed and fully recognized, it might be underwritten along with your closing might possibly be scheduled.

How Newrez Rises

Newrez works nationwide while offering some mortgage options. Of several borrowers will most likely pick an item that works well having their items, and team allows you to try to get and you may manage financing on the internet.

While doing so, the business has no a user-friendly mobile app, that will if you don’t interest customers exactly who gain benefit from the simplicity and you can convenience of with the mobile phone to cope with their finances. As well as for users whom choose a more old-fashioned, face-to-deal with interaction, the business doesn’t have physical locations that a borrower may find financing administrator physically.