If one makes less than the brand new median earnings towards you along with a desire to individual assets in the rural The usa, then you as well as your members of the family are most likely qualified to receive home financing financing supported by the fresh new U.S. Agency away from Agriculture’s Outlying Advancement Secured Construction Mortgage program, described as good USDA mortgage or Outlying Development loan. Sometimes, USDA loans have been called Area 502 finance, shortly after section 502(h) of one’s Casing Operate from 1949, that produces the new USDA’s mortgage applications possible.

USDA fund are built to help you prompt growth in outlying communities across the us. The newest USDA considers people elements which are not part of an urban area as an outlying urban area, including of a lot suburban teams. In reality, on the 97 per cent off end in the nation is regarded as rural.

What is actually an effective USDA loan?

USDA funds prompt homeownership for people within the rural communities with problems being qualified to other, more traditional mortgage loans. Loan loans can be used to pick, renovate otherwise refinance a home for the an outlying otherwise suburban city.

The USDA Rural Development’s construction system claims single-household members construction fund for lower- and you will moderate-income earners in the outlying components. Guarantee doesn’t mean that each candidate usually be considered, but alternatively the USDA often reimburse loan providers if a debtor bad credit personal loans Minnesota non-payments toward mortgage. Since the bodies performs most of the danger of the mortgage, lenders are able to provide lowest-interest funds, even versus a downpayment.

How does an excellent USDA mortgage really works?

You can purchase a USDA mortgage off personal banking companies and you may financial loan providers. In place of old-fashioned mortgages, is entitled to a beneficial USDA financing, you ought to fulfill specific limitations with regards to your earnings and you will venue, together with domestic in which the loan try granted have to be owner-occupied. All the USDA funds include fifteen- otherwise 30-12 months repaired rates.

Before you can end up being recognized to own an excellent USDA loan, a lender often examine your credit report and you can repayment designs to determine if you are qualified. Qualified homebuyers can be qualify for as much as completely financial support, definition they won’t have to build a down payment anyway. USDA loan choice are loan claims, head finance and do it yourself money:

- Mortgage guaranteesYou are able to use a beneficial USDA financing be sure to construct, increase otherwise relocate your house from inside the a prescription outlying city. Become eligible for a beneficial USDA mortgage make certain, you prefer a great 620+ credit rating and less a personal debt-to-earnings proportion lower than 50 %.

- Direct loansLow- and also reasonable-income thresholds so you can qualify for good USDA direct mortgage will vary because of the place, however, usually you must make 5080 % of mediocre average earnings for your area. Government subsidies allow interest levels become while the reasonable due to the fact 1 percent, and you may conditions lasts up to 38 ages. Attributes funded thanks to head mortgage funds need certainly to essentially end up being below 2,100000 square feet and you will value less than the mortgage limit for the area. The home can’t be readily available for industrial interest or include an in-floor swimming pool.

- Home improvement loansAs an element of the USDA’s mission and come up with safe and you will hygienic casing offered to reasonable-earnings parents inside the outlying groups, do it yourself finance and you will has can be used to resolve or exchange roofs, floors, Heating and cooling products and more. Both named a good 504 financing, this type of money try getting people 62 and you may old who require loans to own essential home repairs and you can advancements. So you can qualify, you must make lower than fifty percent of the average income in your neighborhood. Funds arrive around $20,000, and you may has arrive doing $7,five-hundred.

USDA qualification requirements

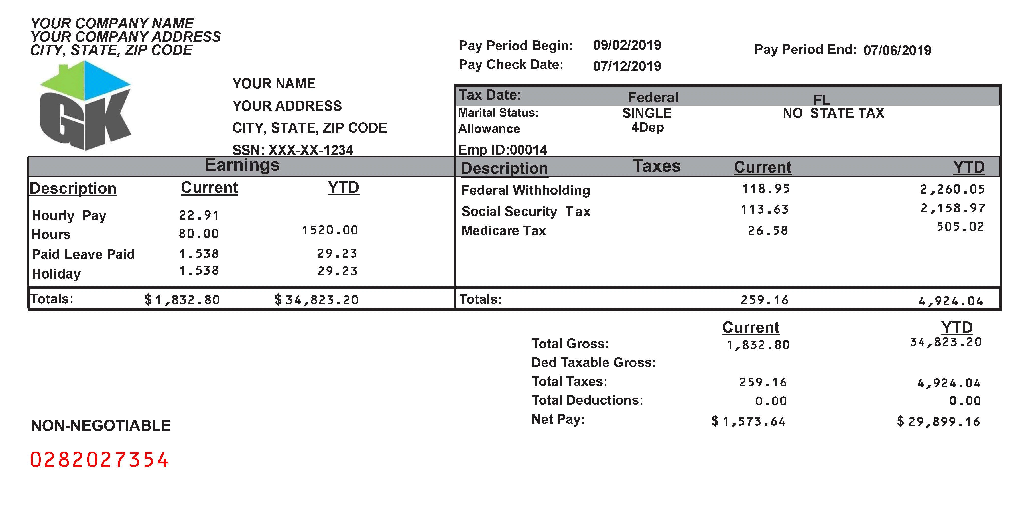

In a lot of suggests, trying to get a beneficial USDA financing feels like trying to get any home mortgage. You need to prove what you can do to settle, always that have pay stubs and you may tax statements, as well as have meet the USDA’s other qualification criteria: your earnings need to be not nearly as expensive the latest average income in the your area, and property your fund which have a good USDA loan must meet specific conditions.