Seemed Strategy

After you’ve calculated to get property unlike rent, you should get approved to have a home loan. Then you will want to undergo a multiple-month underwriting process that climaxes to your closing date the day your perfect home theoretically will get your home.

The fresh new magnitude of the property buying processes can’t be exaggerated. Mathematically speaking, you reside more likely the biggest, costliest purchase you actually make. It is to your advantage to do it the proper way.

One to starts with the right home mortgage. Well-understood alternatives abound, away from conventional mortgage loans that traditionally want 20% off, to help you FHA mortgage loans that require as low as step three.5% down, in order to Va mortgage brokers getting armed forces servicemembers as well as their parents. Countless homeowners be eligible for one among these three greater groups of mortgage brokers.

Think about less frequent options? People can be found also. One of the most fun and financially rewarding home loan selection is brand new USDA financing, a kind of mortgage tool set aside mainly for citizens out of outlying organizations. USDA financing designed for the acquisition or refinance from adequate, more compact, decent, safe and hygienic dwellings as his or her top home inside eligible rural areas.

Given because of the Us Company off Agriculture, the fresh USDA mortgage system are formally referred to as USDA Outlying Development Protected Property Mortgage program. USDA purchase financing are now and again called Part 502 finance. USDA repair finance and you may offers are often referred to as Area 504 money otherwise offers.

When you are weigh your own home loan choices and you will believe you can qualify for an excellent USDA financing, read on. In the following paragraphs, we are going to talk about the different varieties of USDA loans and promises, parameters and you can earliest eligibility standards, well-known closing costs, as well as the major differences between USDA and you will old-fashioned funds.

What exactly is an excellent USDA Mortgage?

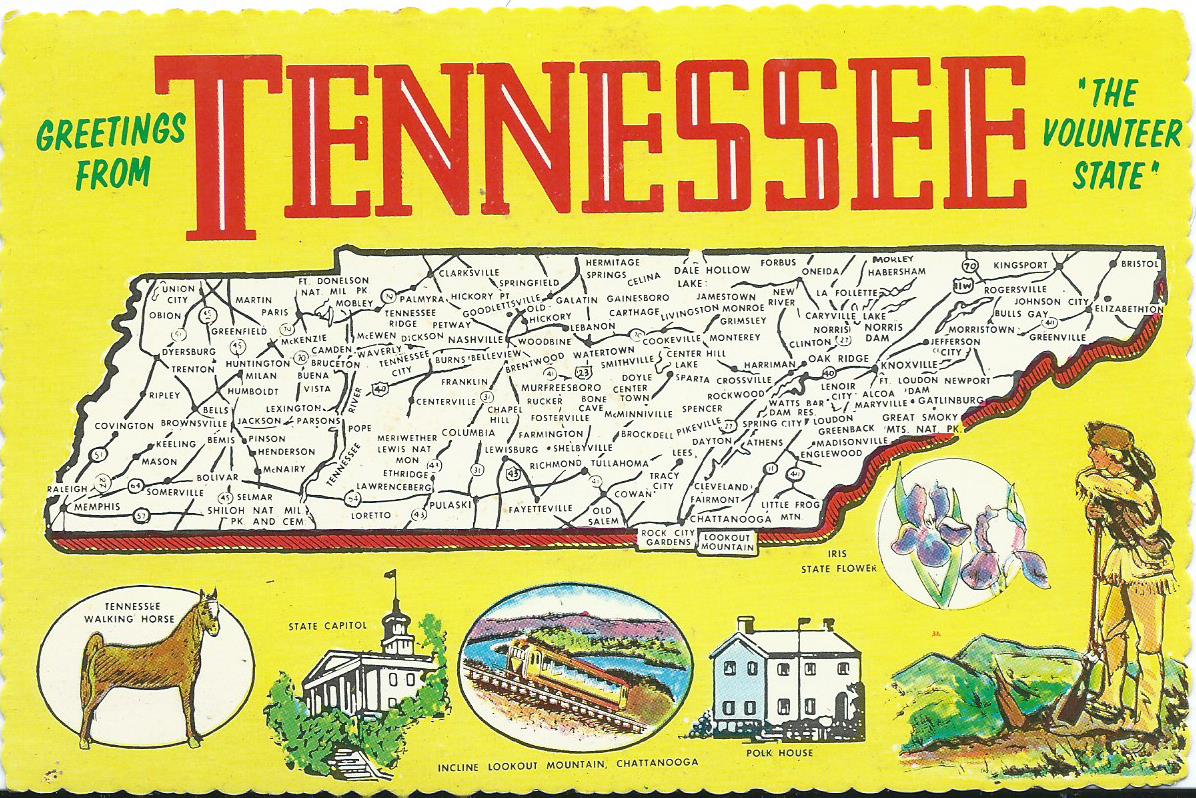

USDA funds are designed for lower- and reasonable-income homebuyers and you will property owners when you look at the eligible components, that your USDA represent since the rural components having a society below 35,100. To choose whether or not the region in which you want to to purchase is eligible, browse the USDA Outlying Invention Program Eligibility Chart.

The geographical limit is actually overriding: Even although you see every other qualification conditions, you can not be eligible for good USDA mortgage whenever you are buying (or repairing) a holder-occupied household away from eligible region. Although majority of your own United States’ house area is USDA-qualified, the majority of one to property try sparsely inhabited, very really Us americans don’t qualify.

USDA finance will be originated by private lenders and you will protected by the USDA (guaranteed finance), otherwise began by USDA itself (head fund). USDA gives are paid regarding USDA funds.

USDA funds possess very lax deposit requirements. Oftentimes, zero advance payment needs, even though putting currency off can be without a doubt slow down the enough time-title price of the mortgage.

USDA finance also have lax conditions having people having incomplete borrowing: Credit scores less than 580 aren’t necessarily disqualifying. For customers which have limited otherwise nonexistent borrowing from the bank records, solution (non-credit) underwriting methods can be found, such as for example verifying punctual and consistent https://simplycashadvance.net/loans/payday-loans-alternative/ rent or utility costs.

These characteristics create USDA finance good for straight down-money customers and you may people, buyers with poor credit, first-date people, and you can consumers and you may people with just minimal individual offers. not, beyond the geographical limits, USDA fund involve some key drawbacks. Somewhat, they need buyers to bring pricey financial insurance rates.

Kind of USDA Mortgage loans

Are typical available for proprietor-occupants. They cannot be used by landlords or next property owners. All of the possess fixed pricing there is absolutely no particularly situation because a varying rates USDA mortgage. USDA financial costs include lower (often by as much as a complete payment area) than simply equivalent old-fashioned mortgage pricing. They might be roughly in accordance with costs towards Va home loans and Va improve refinance finance.