Whenever you are jobless and look for yourself the desire to help you a mortgage, it is generally tough. With no regular funds perhaps the time when you need so you’re able to borrow money more, nevertheless the ineffective routine earnings perhaps have effect your self app are acknowledged.

It isn’t possible that have loan providers nevertheless, once they could possibly offer money to people who happen to be underemployed. They will finished well worth monitors if in case can pay for the new designated monthly payments, you’re recommended for step 1 into the funding.

Lenders who supply finance to those which were out of work, ordinarily specialize inside the financial products for those into the low income or which have a bad credit rating. They’ve been options to traditional loan providers, taking loan applications from people in numerous cash.

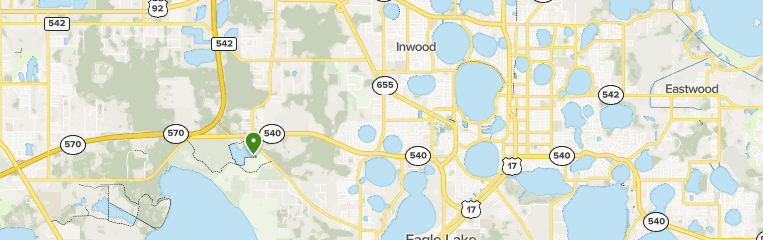

The types of unsecured loans pay day loans in Jackson these firms basically promote become pay-day financing which can call for an excellent guarantor. This involves borrowing from the bank small amount of bucks and you will paying off it within this 12 days. Absolutely nothing finance for those which is underemployed, implies you are not connected with a lengthy-identity financial determination.

If not manage the borrowed funds against an advantage otherwise enjoys a guarantor, you do not have the choice to want plenty of revenue while you are out of work.

How do financing for the unemployment manage?

Delivering a loan when you find yourself unemployed is useful like one other type of financing, their apply straight to a lender otherwise through a broker and they’ll consider your application against their qualifications requisite. For every single financial you will some other need, and this if your wanting to pertain together, show if you’re qualified. If your product is approved the bank often offer funds and collect the money on instances concluded upfront.

You could potentially of course select the financial products you are licensed to try to get ‘ve got a larger attract next other forms away from personal unsecured loans. It is because there’s a lot significantly more opportunity towards financing business towards currency not getting reimbursed because of your useless money.

Can i essentially be noted for a loan basically’m out of work?

There’s no guarantee the software for a financial loan could well be recognized. Best debt updates and you will credit history was, a lot more likely you happen to be to possess depending having a beneficial bank loan. Learn how you’ll be able to boost your probabilities of bringing approved for a financial loan lower than.

A responsible financial are always intricate an obligations and cost decide to try before making a credit decision. This means when you have enough money the fresh new financial obligation, your application you will declined to possess:

- A woeful credit ranking

- Are reported bankrupt, trying to find an excellent sequestration, doing an obligations help Order or someone Voluntary agreement more the very last six decade

- Multiple possessions applications

Could i become home financing with no revenue anyway?

Resource feel sanctioned on the basis of the debtor’s capacity to feel the decided agreements, if you have no program production your chances can be a great good deal down. You are competent to apply for an effective guarantor capital though. That’s where a beneficial guarantor have a tendency to signal for any capital close to you and are the main cause of carrying out any settlements that you simply cannot.

If you are contemplating borrowing from the bank but have zero typical incomes we need to think be it by far the most easily useful get to take on. The additional payments per month, cause a supplementary stress on money and may even set you when you look at the a tough finances. Your collected so it bucks fears web page to assist whenever you are distress your bank account.