This can be ways to help the amount you might acquire by adding a family member or friend’s income on the financial software (and additionally they are not to the deeds on assets).

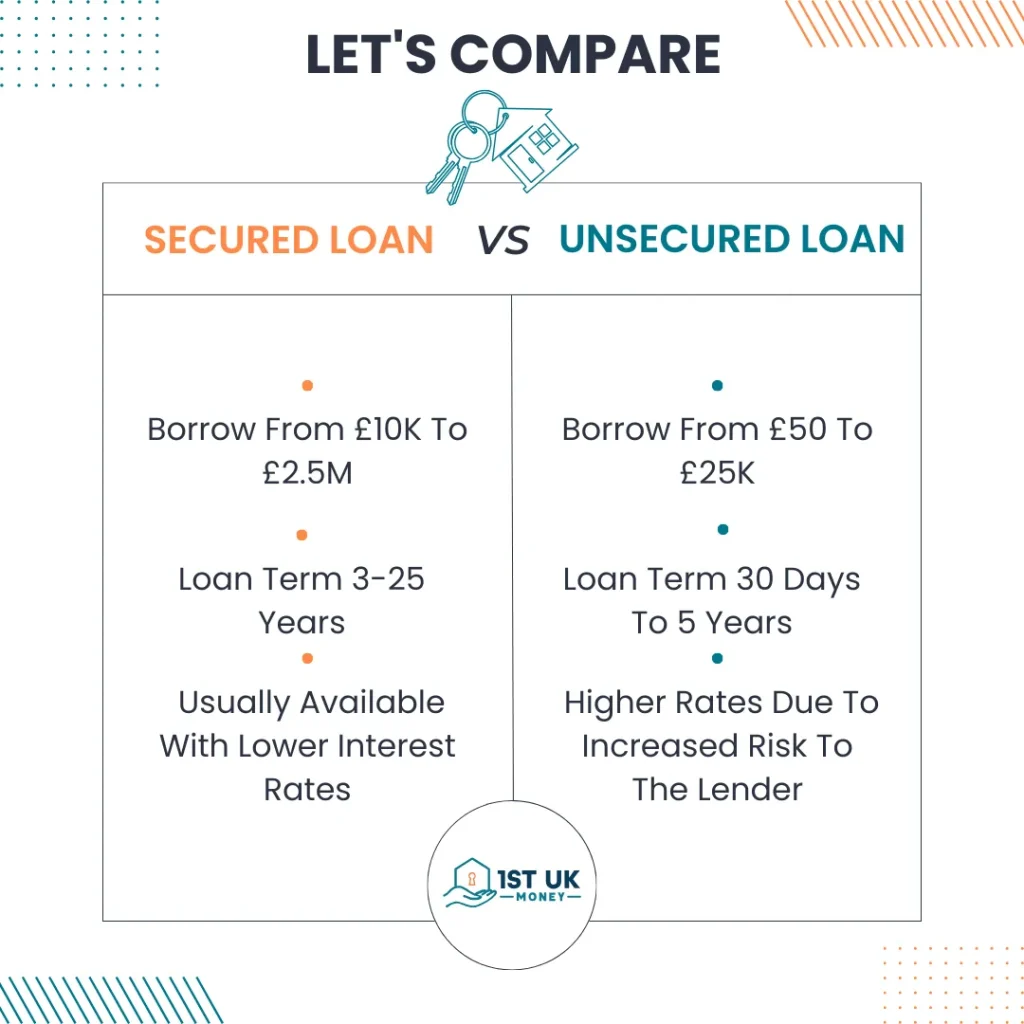

When you are rejected, you are eligible for the next costs mortgage, called a guaranteed mortgage.

Whenever you are struggling to manage it higher loan amount by the on your own, you could think a full time income Boost remortgage

Alternatively, a relative may want to provide you the money. They can fool around with their coupons to provide for you during the a lump sum payment, or put them when you look at the an alternative checking account to be used since coverage from the lender. That is entitled an excellent springboard financial, otherwise Loved ones Guarantor financial, and therefore normally works by your spouse establishing ten% of the property speed inside the a family savings. After a certain amount of big date, they’ll manage to get thier money back plus attract, so long as you maintain the home loan repayments for each and every times.

One other way loans Storrs to own a loved one to assist will be to launch guarantee from their residence using later existence home loan alternative. Eg, in initial deposit Increase is an easy method to possess a relative to help you open some cash using their property using an effective remortgage. This will after that end up being talented to your people trying to purchase their ex-partner out of a property.

Without having one relatives otherwise family unit members who will help, you should never remove center. Discover possibilities available to you of these and no family relations assistance. That option is to use an exclusive collateral loan to obtain one minute fees home loan resistant to the home. The lender will provide you with the other financing you prefer to cover the the home your self by increasing your off fee, in exchange for a share of the house.

Talking about specialist fund, therefore inquire a mortgage broker to have let

For folks who work in a specialist industry, brand new NHS or some other trick staff character, you might like to qualify for a mortgage well worth up to five to six moments their income having a specialist Mortgage or NHS otherwise Trick Worker Home loan.

If you want help workouts your best option to you personally, we can help. All of our wise tech work out the best bet for you centered on your individual value. To start, only would a free of charge Tembo package. Up coming, your faithful mentor from our professional financial cluster can also be walk you through the choice and then tips.

If not buy your ex partner after a divorce or age remains with the mortgage, chances are they will need to remain make payment on mortgage. You are either responsible for the month-to-month payments, thus no matter if your ex has moved aside he or she is nevertheless lawfully accountable for the mortgage financial obligation as long as its name remains on the home loan, even when the financing was just predicated on you to man or woman’s earnings.

For people who or your ex does not pay-off its display away from the mortgage, this leads to your being chased by the home loan company to repay your debt and may even negatively feeling your fico scores, it is therefore much harder borrow funds subsequently.

Up coming separate that it by the amount of residents locate each individual’s show until there was a specific arrangement one lays away how the equity should be broke up.

While struggling to find a method to pay the financial alone, keep in touch with Tembo. The audience is experts on helping home buyers and you may movers increase simply how much capable use compliment of a range of professional systems.