Providing users like you go their economic goals is i carry out, for this reason , we’re equipping your with our specialist understanding, information, and recommendations to acquire around.

- Financial Things

- Property Solutions

- Existence & Home

- Re-finance Alternatives

- APM Insider

Off payments can be one of more overwhelming elements of the fresh homebuying procedure. We know, it is tons of money! Luckily, you don’t necessarily must drain your own deals ahead up for the contribution. You will find several other ways to safer a deposit, in addition to provide money, offers, and you will down-payment guidelines programs.

We laid out all three to help you determine if any of them options are suitable for your financial situation. It’s important to understand that the rules for those kinds of deposit advice will vary because of the state, part, and even city and therefore are subject to change when.

Current Financing

Current is among the greatest four-page terms nowadays-and for valid reason! Of course you like researching money to possess special occasions including wedding receptions, graduations, birthdays . . . or simply because we are to shop for a property and a loved one to really wants to help us aside.

In either case, provide fund try a sensational way to take some of one’s stress from the homebuying processes. You can find, however, a few actions you should go after if you are planning to play with a critical monetary gift for your advance payment.

Let’s begin by exactly what tall monetary gift most form. To possess traditional fund, it is typically identified as one amount of money you to definitely equates to more than half of overall month-to-month qualifying earnings. Particularly, if one makes $3,800 thirty day period, a life threatening monetary gift do include any unmarried put equal in order to or larger than $step one,900. Having FHA otherwise USDA financing, the gift fundamental are something larger than one percent of your residence’s price otherwise assessment well worth, any sort of is leaner.

The mortgage app processes generally is sold with sixty days’ worth of bank comments, for example an enthusiastic underwriter would like to understand the source out-of any huge amounts which aren’t accounted for on your own reputation of assets and earnings. To not care and attention-this type of present money can be simply acknowledged courtesy something special letter you to definitely lets this new underwriter learn which cash is, actually, a gift and never that loan. This new page should keep the gifter’s title, address, phone number, regards to you, dollar amount gifted, and you can day of your own present.

These are the fresh gifter, there are parameters towards the just who is also present your money that will be useful for a down payment. To possess payday loan companies in Daniels Farm Connecticut antique funds, which provide has to come from a family member, that tend to be people regarding partners to help you action-aunts, adopted cousins, grandfathers-in-rules, and you can domestic people.

Including gifts out-of family unit members, FHA financing also will let you receive provide money from your own employer, work commitment, otherwise a charity. USDA and you can Va fund enables you to located provide funds from almost anyone- for as long as that individual isn’t involved in the home exchange. That it disqualifies the fresh residence’s seller, builder, creator, or either party’s realtor.

Remember that even though you don’t need to spend taxation on gift fund, the person providing new present may just, it is therefore constantly best if you keep in touch with a tax professional prior so you can initiating this action.

Grants

Down-payment offers may help fill the brand new emptiness amongst the currency it is possible to developed for an advance payment additionally the leftover down payment harmony. Downpayment guidance grants are given compliment of regulators firms including the Institution away from Homes and you can Metropolitan Development (HUD) and you can due to low-profits like National Homeowners Loans.

Even if these types of software can differ by the state, matter, and requires, they generally look at the cost of the home and you may geographic area, plus earnings and you can credit history. Specific gives are also considering for people in certain specialities, like law enforcement, firefighting and you can EMT. Check with your condition, state, town, and you may relevant elite contacts to find out if they supply any give apps that may apply to you. The loan coach will additionally learn about a few of the applications available, so be sure to ask them while you are trying to find more information.

Has typically provide so it deposit recommendations 100 % free and you will obvious, definition you don’t need to spend the money for cash return, though you ought to look at the fine print. Particular applications start from stipulations such as for instance good recapture several months, which means that the bucks is only free and clear for those who remain in our home having a particular long-time.

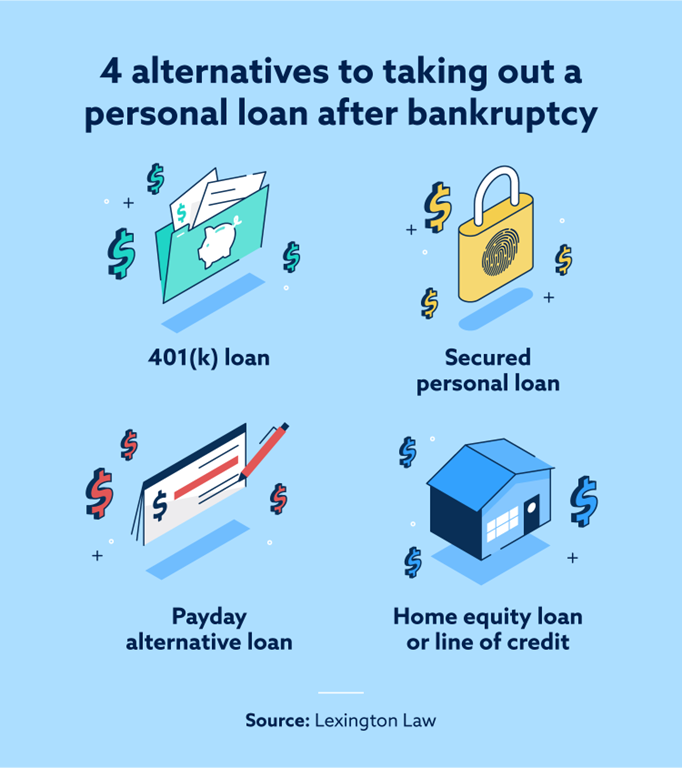

Loans

Down-payment recommendations funds try a general classification that mean many different one thing. This can start from appeal-totally free, forgivable loans so you’re able to interest-totally free deferred-percentage money plus low-desire money. These types of financing programs supply a selection of requirements, which could become income constraints, acknowledged geographic locations, to order a house beneath the considering median family price for that area, how much cash you’re able to lay for the your own down payment, and more.

Down-payment guidelines financing applications can come out of federal, state, city, condition, and charitable finance and often has actually several solutions. Particular deposit direction applications might allow you to make use of these money to possess settlement costs.

Although not all homebuyer commonly be eligible for down-payment guidelines-or perhaps lucky enough having a big cousin-they’ve been well worth looking into. Investigating all your valuable selection just before plunking off their tough-received money is a terrific way to place your mind at the simplicity when it comes to the fresh feared subject regarding off costs. Perform yourself a support to discover what you may be eligible for! The loan advisers try right here and able to help select choice getting you to your one to dream domestic. View here to find an APM Financing Advisor towards you.