Exactly how pleasing so you’re able to desire having your individual cabin on the payday loans Malvern lake to collect the family and you will members of the family to have splendid excursions. Running a vacation or next family results in delight, joy & most higher recollections.

In fact, the brand new 2017 National Connection regarding Real estate agents (NAR) Capital & Travel Domestic Customer’s Questionnaire indicated that 42 per cent ones to shop for the second house exercise to make use of while the haven having members of the family. To get percent want to transfer the trips household within their number one house subsequently to own old age, and twelve % ordered the area because of reasonable a home cost.

Prior to you start making men and women aspirations come true, you initially should get preapproved to buy one 2nd domestic, says Paul Mitchell, Senior Mortgage Creator within Austin Money Financial during the Houston.

This can be your second home loan. So, you have to know for people who qualify, just how much your instalments could be, as well as how the afternoon to-day cash is affected, the guy contributes.

Exactly what financing is available having next otherwise travel property?

The latest NAR questionnaire revealed that 30 per cent away from travel buyers paid off all-dollars because of their buy. Whenever money the purchase, 45 percent financed below 70 percent of its get. This means it generated a massive downpayment. If someone else will not spend having cash, they usually see with a conventional loan, that would become financing sold so you can Federal national mortgage association and you will Freddie Mac computer, Mitchell says. Very mortgage people promote antique money which vary from ten and you may three decades.

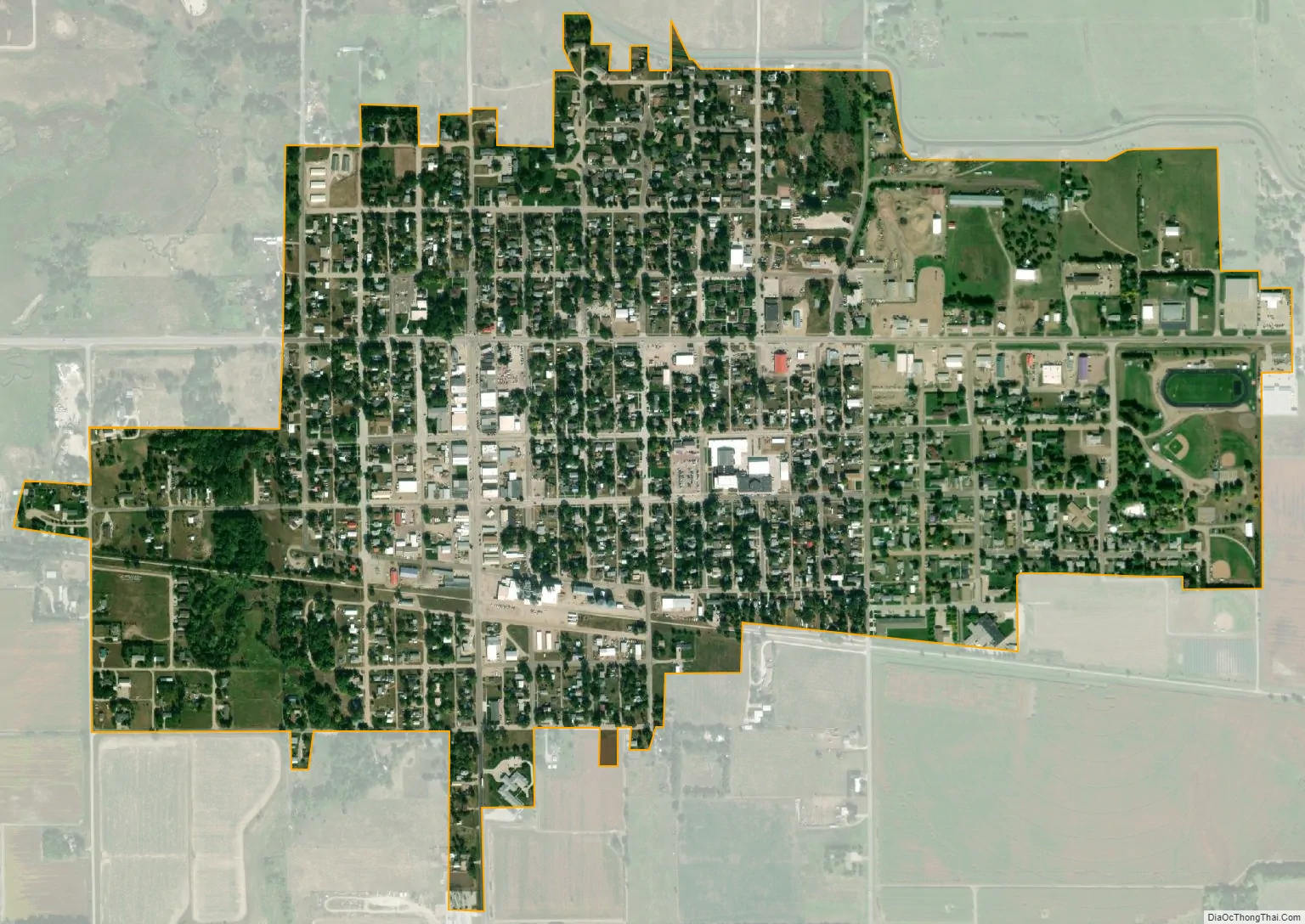

Mitchell says that FHA and you may Va mortgage choices are only available for the first household. That said, when your next residence is gonna be the new first quarters, there might be alternatives for a great Virtual assistant financing. USDA is offered according to whether or not the city youre to invest in when you look at the was designated as such.

On the one-fifth out of people make use of the guarantee in their number 1 home so you’re able to make down payment on their vacation domestic. Some have fun with a cash-aside refinance to their number one domestic as they has actually reasonable security to the boost in home values not too long ago. You might like to have the ability to see a home guarantee line from borrowing from the bank (HELOC) in your number one quarters to get next house otherwise have fun with it your own down-payment. This way, you don’t need to re-finance your existing home loan.

In addition, you may prefer to think purchasing the vacation home with most other family members otherwise friends. Mitchell shares that each people attempting to be on the mortgage have to do another type of application the actual only real time one app you could do for two individuals occurs when he or she is hitched.

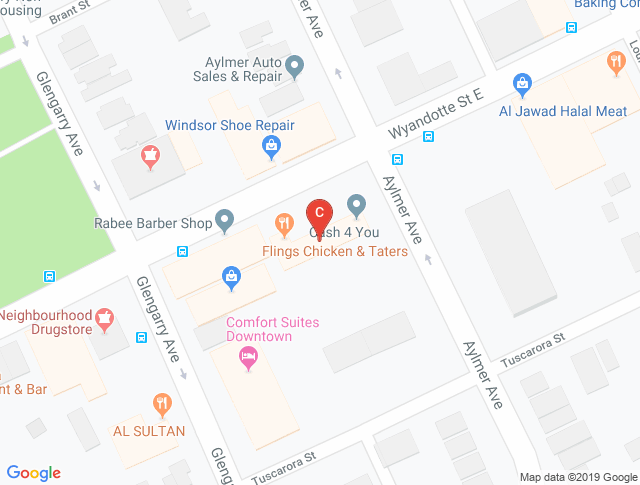

The average price to own a holiday home is $200,000, in respect of the NAR questionnaire. That’s up regarding $192,100000 the year just before. thirty six percent sold in a beach city, 21 percent ordered into the a lake top and you can 20% bought in the united kingdom on regular vacation property becoming 2 hundred kilometers about buyers’ number 1 house.

But think of, the price of travel house keeps everything regarding the area, and several areas of the world tend to be higher priced with each other the fresh shores plus large metropolitan areas.

Get a hold of a representative you to knows 2nd homes

If you are to acquire an extra domestic inside the a hotel, leisure otherwise destination, choose an agent with this options, Mitchell states. They are doing understand the tax implications regarding the next domestic and the vacation existence market. They’re able to help you after to find out for those who you need a home government company to address your home while you are maybe not around, in addition they will reveal how much cash you can aquire whenever renting out of the lay if you’re staying away from it.

The fresh new NAR does offer formal studies and you may help getting representatives which operate in it niche market, to help you pick a resort and Next-Household Assets Pro (RSPS). Mitchell contributes that you should find a realtor who is active and you can lifestyle and you can really works in the region your choosing.

Earliest, I might figure out how much I can utilize it, says Mitchell. Then check if the place is actually rentable for people who aren’t attending utilize it. It may assist recoup the cash you are paying for they.

How is the vacation market full because home prices and you may interest levels is actually upwards?

The fresh new NAR questionnaire revealed that brand new show regarding vacation homebuyers denied on the 3rd straight year to help you several percent from sixteen percent. The fresh refuse puts new show during the historical mediocre getting studies set amassed because 2003.

What is actually sensed a vacation family?

Mitchell states that when lenders examine a credit card applicatoin getting a vacation mortgage that the home must smelling, appearance and feel such as a secondary household.

It cannot end up being two blocks away from your newest primary home, or even it will be a residential property, he says. It should be next to the liquids, throughout the mountains, with the a lake otherwise in the world. While you plan with the getting leasing earnings on possessions, that cannot help you be eligible for the mortgage. It will help defray will set you back out-of running a secondary domestic, no matter if.

Just what will be a discouraging factor having not getting a vacation family loan?

In the event your month-to-month income try rigorous to maintain each other houses and you can buy taxes, insurance, maintenance, etcetera., up coming taking accepted will get perspective difficulty.

I realize advice, assuming it doesn’t performs, either you possess out of see additional loans or another borrower so you can sign for your requirements, purchase along the interest or lay out a tad bit more, he says.