Upstart brings smaller terms and lower mortgage amounts than many other individual loan providers, partially because they work with people that have reduced-than-top credit.

Running a business as 1985 and more than well known for its borrowing cards, Look for also provides a selection of borrowing products as well as private and you can domestic collateral loans. We chose Select once the best for house equity loans because of the restricted fees, low interest, and large amount borrowed limitations.

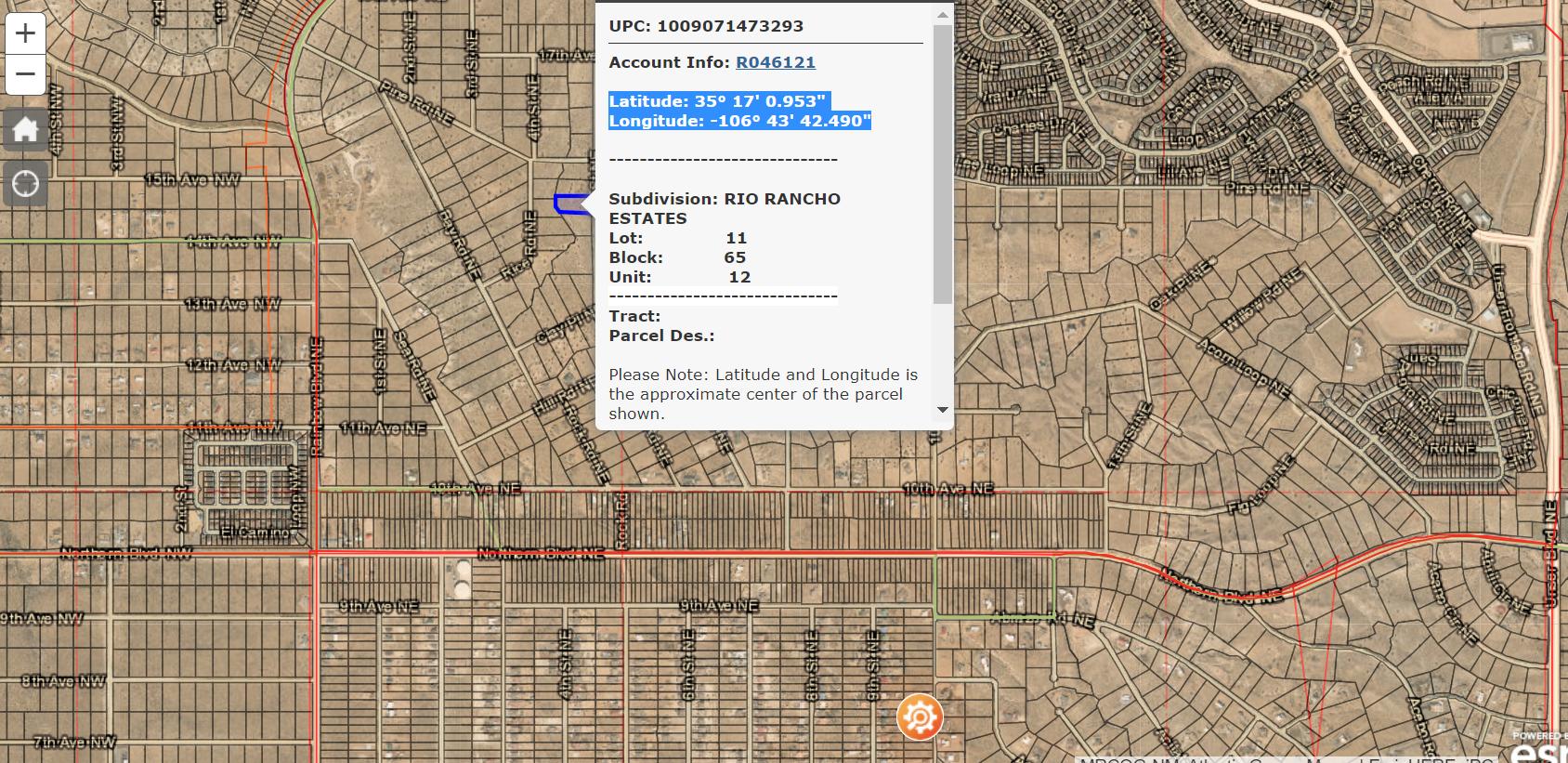

Domestic equity loans let you borrow on the additional equity in your home and employ it getting updates, for example a new pool. You really must have that loan-to-really worth proportion of greater than 80% to help you qualify, that will be determined by a proper assessment. Other benefit to domestic guarantee fund is you can subtract the eye in your taxation, that isn’t provided with unsecured loans. House collateral fund to have a pool will likely be less expensive than a consumer loan as they are covered.

Discover a home collateral financing having Look for, you might incorporate on the internet or over the device, making it easy and convenient. Just after acquiring your loan, that comes having a fixed price and you will monthly payment, you would not need to pay any closing costs in the the mortgage; Discover pays all of those will set you back.

If you’re you will find theoretically zero prepayment punishment, borrowers which pay back the loan entirely would have to spend a few of the closing costs which were very first waived. These types of will not surpass $five-hundred.

Good for Home Collateral Personal lines of credit : PenFed Borrowing Relationship

PenFed Credit Partnership was a beneficial federally-insured borrowing union providing players in most 50 You.S. claims, D.C., Puerto Rico, Guam, and Okinawa. As well as antique banking items like checking and you may savings accounts, they also render financing. We chose PenFed Credit Relationship since perfect for house equity outlines out-of borrowing (HELOC) because of its low interest rates and you can minimal charge.

Which have a great PenFed Borrowing Union HELOC, you might over the application on the internet free of charge. The degree of your loan along with your rates depends on a good particular facts as well as your mutual loan-to-value proportion (CLTV), that is associated with how much guarantee you may have on the domestic. The greater number of security, the low your interest. PenFed allows a mixed financing-to-value-proportion as high as ninety%.

PenFed Credit Union will pay extremely settlement costs, and there is an excellent $99 annual payment that’s waived for those who spend even more than $99 for the interest in the last one year.

What exactly is a pool Loan?

A share financing try financing you take out over shell out having a swimming pool installed yourself or rental possessions. The majority of people pay money for swimming pools playing with personal loans, family security fund, or HELOCs.

A personal bank loan was a personal loan, which means there is no equity support the mortgage. In the event that a borrower non-payments on an unsecured loan, there’s nothing towards the bank to help you repossess. A guaranteed mortgage has actually guarantee, such a house security loan otherwise HELOC.

Generally speaking, interest levels is lower getting secured finance than simply unsecured money. This new disadvantage to having fun with a home guarantee financing or HELOC was that in the event that you standard, the lending company can micro loans Woodmont no credit check repossess your property. This won’t takes place if you have a personal bank loan.

Which Need to have a pool Mortgage?

To cover a share using a consumer loan, you usually you need a credit history around 600 or even more. Particular loan providers may also have earnings standards, which will vary. Family equity money and you will HELOCs commonly need a rating regarding 680 or even more. You can nevertheless rating a share financing if you have a beneficial down credit score, but you will spend large rates, and then make your own payment higher also.