Most people dream about having their own household, but rescuing the cash you installment loans for bad credit in Lawrence IN desire for the fantasy household can be be daunting. The latest rising cost of housing all over the country are hampering the market industry, and buying property needs careful economic believed. However, first-day homebuyers from inside the Missouri provides numerous resources accessible to help book them by this active procedure.

Lower than, i explanation four primary points to bear in mind as you start your own Missouri domestic seem and get you a stride closer to to be a first-time citizen.

step 1. The key Choices

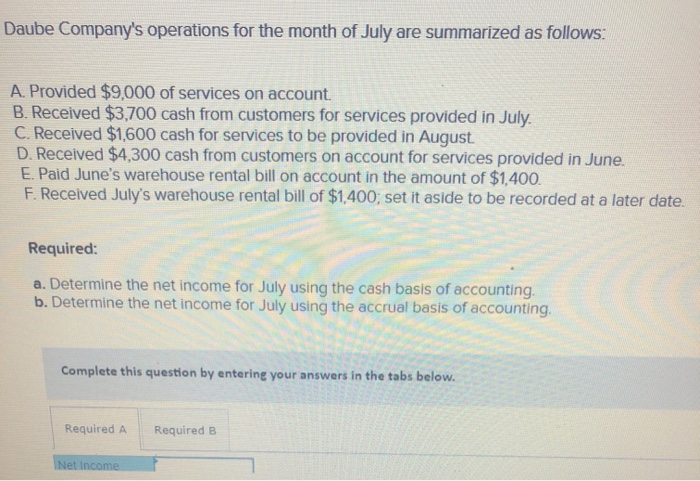

What are the standards to shop for a home during the Missouri? When you find yourself examining the market for the first time, a highly-constructed financial bundle and you will a significant down-payment are essential. Here are some solutions to make it easier to secure very first home as opposed to damaging the bank.

To help make a proper budget, determine your month-to-month domestic money immediately following fees, then meets they into month-to-month expenditures. Endeavor to has actually an excess each month (regardless of if 64 percent from Americans live paycheck so you’re able to salary, according to you to report). Without having somewhat sufficient to booked deals for every single day, work through your financial budget locate any stuff you will cut straight back onto supplement their discounts.

Within your home-to acquire budgeting process, understand what their target matter is actually for a down-payment. Start with searching on the internet observe exactly what casing costs appear to be towards you.

A down-payment is actually proportionate on the price of a property. When you look at the the best business, people pays 20% while the a down-payment. Lenders generally speaking make use of this number given that a limit because it provides them enough leverage if you cannot shell out your own financial.

Whenever you are invested in placing off 20%, your own deposit fund will determine the absolute most you’re able to expend to the household. A 20% down-payment including helps you to save away from being forced to purchase an agenda that protects the financial institution even though of a foreclosure (more on you to definitely eventually). If you possess the economic mode, buy so it number when you find yourself strengthening their offers.

dos. The fresh Possibilities

Certain types of mortgage loans cater to specific consumers inside book circumstances. Only some borrowers be eligible for this type of financing, nonetheless it will probably be worth because of the adopting the selection:

Federal Houses Management (FHA) Mortgage

A federal Housing Management (FHA) loan try a loan product that is generally attractive to first-date homebuyers due to its low income limitations or other requirements. This type of funds, being insured by FHA, offer lowest- in order to moderate-money borrowers which have loans which make owning a home significantly more obtainable-even although you have less-than-prime credit. These loans provide the very least advance payment only step three.5 per cent of home’s worth. Missouri FHA loan limitations will vary from the county, however, every solitary-friends residential property in the Missouri be eligible for mortgage amounts around $472,030 for the fund supported by the latest FHA.

Army Veteran Loans

When you are an armed forces experienced, you could qualify for special Experts Issues funds or features that offer personal costs and you will terms into mortgage loans. These types of mortgage programs even were home loan products which don’t need any deposit anyway.

Assistance Applications to have First-Day Homebuyers in Missouri

The fresh Missouri Basic-Time Homebuyer Savings account was made for basic-time home buyers inside Missouri to enable them to conserve having an effective brand new home. Brand new effort makes you put up to $step one,600 each individual (or $step 3,2 hundred having people) of shortly after-taxation bucks per year and discovered 50 % out-of a state taxes to your number transferred. All of the accumulated notice for the account is taxation-liberated to cut having a downpayment. Moms and dads and you can grandparents may also set-up an account fully for their pupils and grandchildren. Missouri earliest-big date homebuyers also can explore a handful of most other county-certain loan choices given by the Missouri Casing Innovation Fee.

step 3. Another Factors

The newest closer it’s possible to arrive at one to 20 percent down fee endurance, the greater the homeloan payment selection is. But when you are unable to somewhat hit one to draw, don’t proper care. Of numerous lenders bring self-reliance so you’re able to fund your residence purchase.

Paying for Private Mortgage Insurance rates (PMI)

In the event one may get a house as a result of a conventional loan with less than 20 percent off, think about the needed added cost off personal home loan insurance (PMI). PMI try a secure accustomed include loan providers even if new consumer can’t spend their mortgage. Unlike utilizing the downpayment as the power, homeowners buy an agenda that compensate the lending company during the the function out-of property foreclosure.

PMI try added to the mortgage before the guarantee about domestic surpasses 20 percent, where section the insurance coverage is taken away. People do so through regular monthly payments, carrying out home improvements, otherwise experiencing an increase in the fresh house’s assessed worth.

Making the most of Your money

Because you continue steadily to save yourself having a deposit, you want a rut to store their coupons and you can optimize that money. We recommend your get involved in it secure by steering clear of risky investment. Pick a reputable, interest-affect checking account otherwise currency industry account. Assets would be attractive, especially today. But not, it seldom pay for a while and may also influence in a serious loss which is often difficult to get over. Nevertheless they are not covered, in place of a checking account.

After you have the best checking account build, initiate putting away bucks towards the deposit. One of the most effective ways to save is by cutting down into the one unnecessary or too much expenses. Utilize the home funds you developed to choose needless expenses you may clean out.

Whether or not it appears impossible, you should consider to get property instead of investing book. Specifically given that a primary-day domestic customer, advantages are worth new upwards-top prices. A number of great things about to shop for more leasing is:

- Putting on income tax gurus, such as for instance taxation loans

- That have do it yourself modification prospective

- Acquiring an asset that have admiring worthy of

- Possessing the brand new pride of home ownership

cuatro. The fresh Legitimate Companion to own First-Time Homebuyers in Missouri

While you are getting ready to get a house from the Tell you-Me personally State, make sure to spouse that have regional mortgage brokers you can rely on and explore practical loan choices. 1st step is going for a house that suits your own family members’ needs and your personal tastes. You can learn more info on this new particulars of Missouri home buying of the getting our very own totally free publication, Everything you need to Understand Home loans during the Missouri.