You may have heard about some thing titled a good opposite mortgage’, and this can be one way to supply the collateral on your home. But there are various considerations so you’re able to think about and it’s really crucial understand all the possibilities that would be open to you.

While a resident old 60 as well as, an other financial is one way that you might be able so you’re able to leverage new collateral of your home to gain access to more income. This is not things every loan providers provide Westpac does not as an instance however, there are more an approach to accessibility the new collateral on the household that is certainly considerably better to suit your condition.

Opposite mortgage loans

There are many alternatives for being able to access the money such a normal income stream, a personal line of credit, lump sum payment, or a mix of every.

Options that come with an other home loan

An option feature out of an opposing mortgage is you can remain in your home and won’t have to make payments in order to the financial as long as you’re lifestyle there. When you otherwise your house deal the home regardless of if, the opposite mortgage will need to be repaid towards financial in full.

The eye energized to the mortgage commonly substance through the years. Even though you need not pay back the loan provided that as you’re in our home, attention continues to be compounding during this time. When it comes time to sell, you otherwise your estate would have to repay that it interest in introduction to your loan equilibrium you borrowed from.

Opposite mortgage loans allows you to use a lot more since you age. On a yearly basis, brand new proportion of the home’s well worth as you are able to obtain grows. While the a standard analogy, while you are sixty yrs old, you may also just be able to use 1520% of property value your residence. This could then getting improved because of the step one% per seasons more 60.

To supply a much better concept of their credit ability and you will the new feeling financing are certain to get in your equity over the years, you can make use of ASIC’s Moneysmart reverse home loan calculator.

Considerations away from an opposing financial

While you won’t need to create payments when still-living for the your home, because property familiar with hold the financing comes, the reverse real estate loan harmony will need to be repaid in the complete, plus focus and you will one ongoing costs.

Its worthy of noting you to definitely reverse mortgage loans make use of a keen crucial supply of money (your house), so you need meticulously think about advantages and you can downsides and you can consider carefully your newest and you will upcoming things.

If you are from inside the life’s after grade, it may plus apply at the eligibility into the Decades Retirement. It would as well as help to talk to a suitably accredited monetary otherwise income tax adviser to understand the effects to suit your individual points.

Additionally, its well worth considering whoever lives with you and you can what their reputation would-be for people who perish, considering you reside usually your own greatest investment to be leftover so you’re able to someone else.

Negative guarantee safety

For individuals who took out a contrary financial shortly after or plan to subsequently, you might be protected by brand new no negative equity verify. This is why you might not end due the financial institution alot more than your home is worthy of if the property value the house you familiar with hold the financing falls beneath the property value your a good balance.

americash loans Candlewood Lake Club

Be sure to check your offer for people who got out a face-to-face home loan until then big date. Whether it doesn’t are negative equity safety, it is better to speak with your lender otherwise get separate advice.

A face-to-face financial is but one technique for accessing brand new collateral in your home. Based on your financial and personal affairs, choice selection for example mortgage develops or domestic reversion can be best suited and are generally worth taking into consideration getting home owners and you may borrowers within all the lives levels.

Loan develops

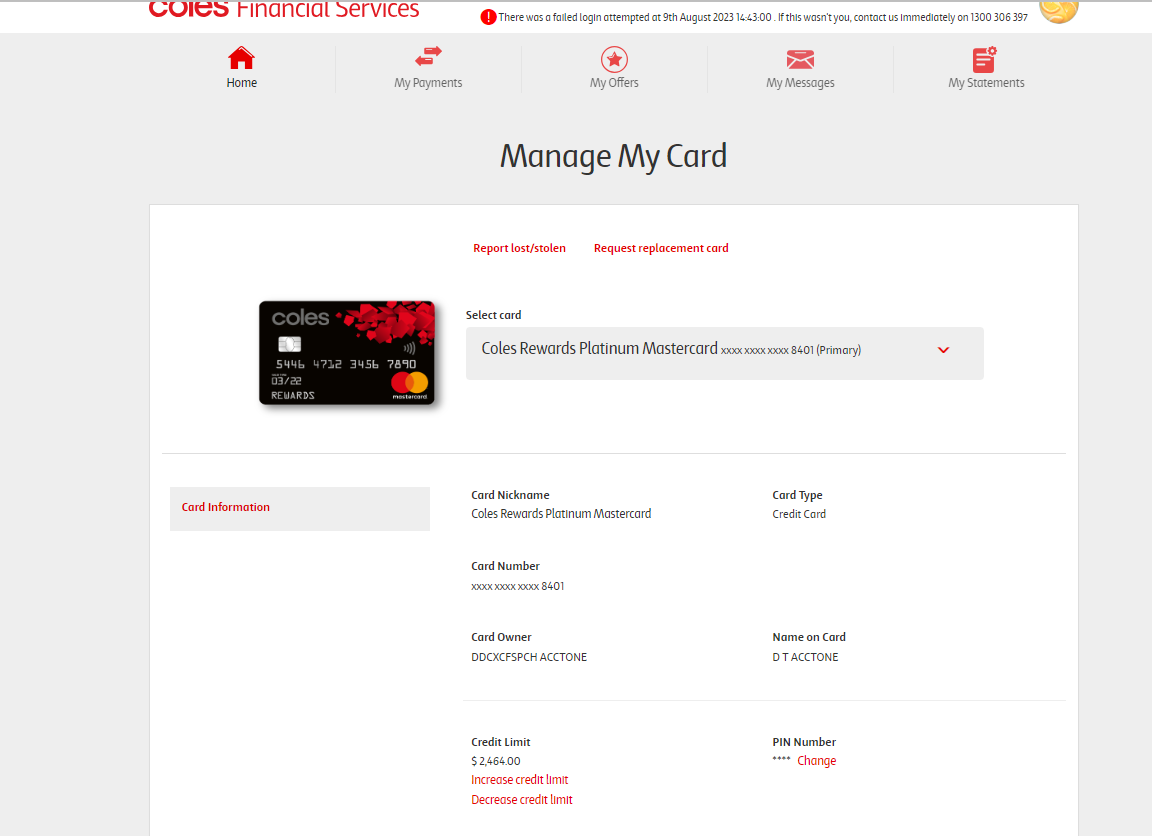

Another way to control your house security is always to borrow funds courtesy a mortgage better right up otherwise boost. You’ll need to incorporate together with your financial to increase your financial maximum to access the excess dollars.

Home financing better right up or raise is based on a great amount of issues. To start with, consult your financial if this option is available for your financing form of.

Additionally, you will should be in a position to build most money, as of the increasing the amount your debt in your home loan, your payments will increase.

While doing so, your financial need a formal valuation to find the latest market price of your house. This is done so you’re able to calculate how much cash available collateral is within your home. You can get a sign of the worth of the house or property of the speaking with an area agent otherwise accessing a keen on the internet estimator such as for example Westpac’s Collateral Calculator.

If you don’t desire to use your guarantee to boost your own current mortgage equilibrium, an alternative choice is utilizing they to set up an alternative, second loan membership.

This may will let you prefer cool features out-of the individuals towards your financial. For example, another payment frequency, version of rate of interest (particularly repaired rate) and you may financing title.

Family reversion

Household reversion is when your offer a proportion of the future security in your home at a discount when you are continuous to call home indeed there in return for a lump sum payment.

The price for your requirements is the difference between what you get to the share of your property today and you will just what one to share may be worth subsequently when you decide to market.

This can be risky as the prices are entirely dependent on the fresh new state of one’s housing market if the sale encounters and this try difficult to assume. It’s really important to get separate suggestions about one coming forecasts and you may see the potential affect your debts so you’re able to weighing right up whether that one suits you.

You simply will not need to pay notice into lump sum since it’s just not that loan. But not, you are going to spend a charge for your order, to truly get your household cherished, and you can also have to spend a lot more property transaction can cost you.

With a number of ways to gain access to the fresh collateral on your family, you will need to envision which choice is best for your position and you can what is available with your own bank.

Westpac does not promote opposite mortgage loans otherwise house reversion, however, we can help current people play with the security which have an excellent loan boost. But not, prior to making your choice, it could be best if you search separate advice on the best way to discover equity of your property.

Have significantly more questions? Call us to your 132 558, for more information on security of your house otherwise head to people branch around the Australia to speak with nearby House Money Director.