step one. See a loan provider

Many financial institutions, borrowing from the bank unions, an internet-based lenders bring FHA finance. You need a large financial company otherwise search on the internet to compare FHA lenders’ top readily available interest levels. You could examine every-from inside the FHA mortgage will set you back between no less than around three mortgage brokers so you can find a very good words for your condition. Obviously, nearby lender otherwise borrowing connection might possibly be a keen FHA lender currently, to help you along with compare its costs.

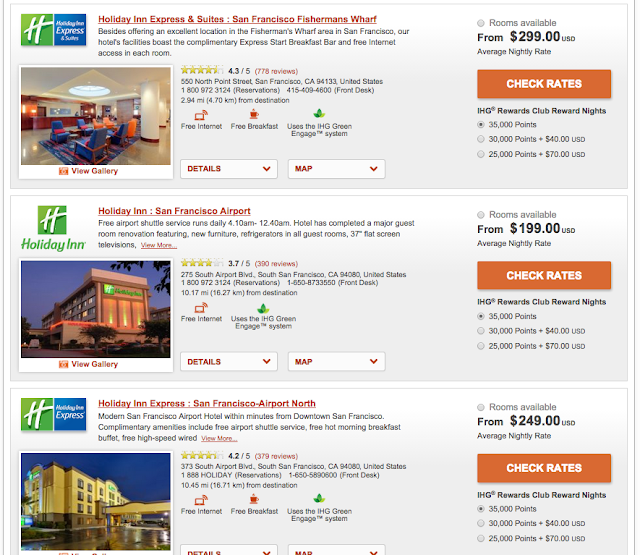

Going for a reputable and you can experienced bank to help you throughout the home loan procedure is very important. You can examine bank critiques to your Bbb and you can together with other on the internet opinion websites. It’s also possible to examine a beneficial lender’s decades running a business and if it offers gotten any problems from the Consumer Financial Safety Agency.

dos. Assemble Needed Documents

- Government-approved ID such as a driver’s license otherwise passport

- The Social Safeguards credit and you can/or Public Safety matter

- During the last two months’ spend stubs

- Tax returns and you may W-2s over the past two years

- Costs or debts that demonstrate abreast of your credit report

- Financial statements that demonstrate discounts getting a deposit.

- Verification of work

3. Fill in Your loan App

You have the option to fill in loan requests on line or even in person. It’s essential to submit all of the recommendations truthfully rather than get off any questioned areas blank. When your loan application try wrong or partial, it could decelerate the brand new acceptance process. Make sure to become all the requested information to get rid of delays.

Brand new FHA mortgage preapproval processes typically takes four so you can 10 organization months. This time physical stature can differ based issues such as the lender’s workload, this new difficulty of the borrower’s financial predicament and responsiveness off the fresh new debtor when you look at the taking the expected records. In many cases, you will get preapproval an identical day.

Just how to Improve Probability of Getting a keen FHA Mortgage Preapproval

You could potentially take the appropriate steps to improve your chance away from FHA home loan recognition, from improving your credit rating to help you communicating with the bank. Here are around three key info.

step 1. Care for A beneficial Economic Patterns

Its important to maintain a stable financial situation when you are looking forward to preapproval. Try not to create big economic change eg making an application for several credit cards or taking out a consumer loan to find the new furniture. Although it can be simple to dive in the future and start believed for your coming house, using up even more financial obligation or while making other economic issues make a difference the preapproval inside app process.

2municate With your Bank

You can stay-in lingering communication with your lender in the preapproval technique to make sure you provide any additional required documents effortlessly. You can even inquire brand new lender’s information and you may seek clarification to understand the FHA loan application techniques by getting in touch with the loan manager. Demonstrating you are engaged in the loan acceptance processes and you will willing to provide any asked papers punctually can increase the chances of acceptance.

step 3. Be ready to Offer Additional Documentation

A lot more records may be required when you look at the finally underwriting process. To get rid of delays cash advance payday loans Eaton, enjoys duplicates out of lender comments, spend stubs, taxation statements and proof most other savings eg later years account so you can inform you lenders whenever asked. You should end up being quick and you can planned when taking these records adjust acceptance chance and reduce waits.

What’s the Difference in FHA Financing Preapproval and you can Prequalification?

Throughout the prequalification to have an FHA mortgage, your earnings, property and you will borrowing from the bank try reviewed, and also you discover a quote off what you could qualify for. With preapproval, the way it is is tell you the new automatic underwriting program for genuine acceptance. While both are equivalent, prequalification ‘s the first faltering step to start assessing your house to buy electricity.