- To purchase property less than framework may offer certain experts with regards to out-of loan resource, as you can use the latest Progressive Percentage design to higher create the cash flow.

- Individuals who happen to be worried about the volatility of SORA-pegged bundles is think a fixed Deposit Speed financial, that’s usually way more steady as compared to SORA rates.

Of numerous Singaporeans are familiar with the term Build-to-order, otherwise BTO, when it comes to to acquire personal casing. A similar layout is Building-Under-Construction otherwise BUC, and therefore means any assets that’s however along the way to be mainly based.

To order a house significantly less than construction gift ideas gurus and you will pressures that really needs careful consideration, and several is almost certainly not conscious investment is more compared to to shop for a ready-built property.

What is actually Strengthening-Under-Structure (BUC) in the Singapore?

BUC characteristics is arranged assets developments that are available for purchase before they are completely mainly based, giving customers the ability to get a property and is able soon.

BUC qualities are domestic condominiums, industrial buildings, and mixed-have fun with developments. Designers constantly bring tools available at the certain things in the property’s advancement on the property purchase stage in order to near achievement. Prior to you get good BUC assets, consider the pros and cons.

Considerations when purchasing a beneficial BUC property

Designer character: In the place of BTOs where designer is typically a government service, qualities lower than construction usually are produced by personal organizations. Its vital to check out the developer’s profile and background just before investing a buy.

ics: Brand new selling marketplace for properties below structure operates in different ways of BTOs. Products such as for instance framework improvements, place, and you can industry request is influence rates and you will selling prospective.

These types of money normally have other terminology and needs, also disbursement dates associated with build milestones, and this consumers need to navigate efficiently.

Extremely financial institutions usually merely render floating rate financial bundles which are labelled so you can SORA price + a spread. The new SORA rate tends to be much more unpredictable since it is founded toward straight away credit cost from the interbank field, ultimately causing they so you can change with greater regularity which have changes in industry conditions, economic products, or main financial policies.

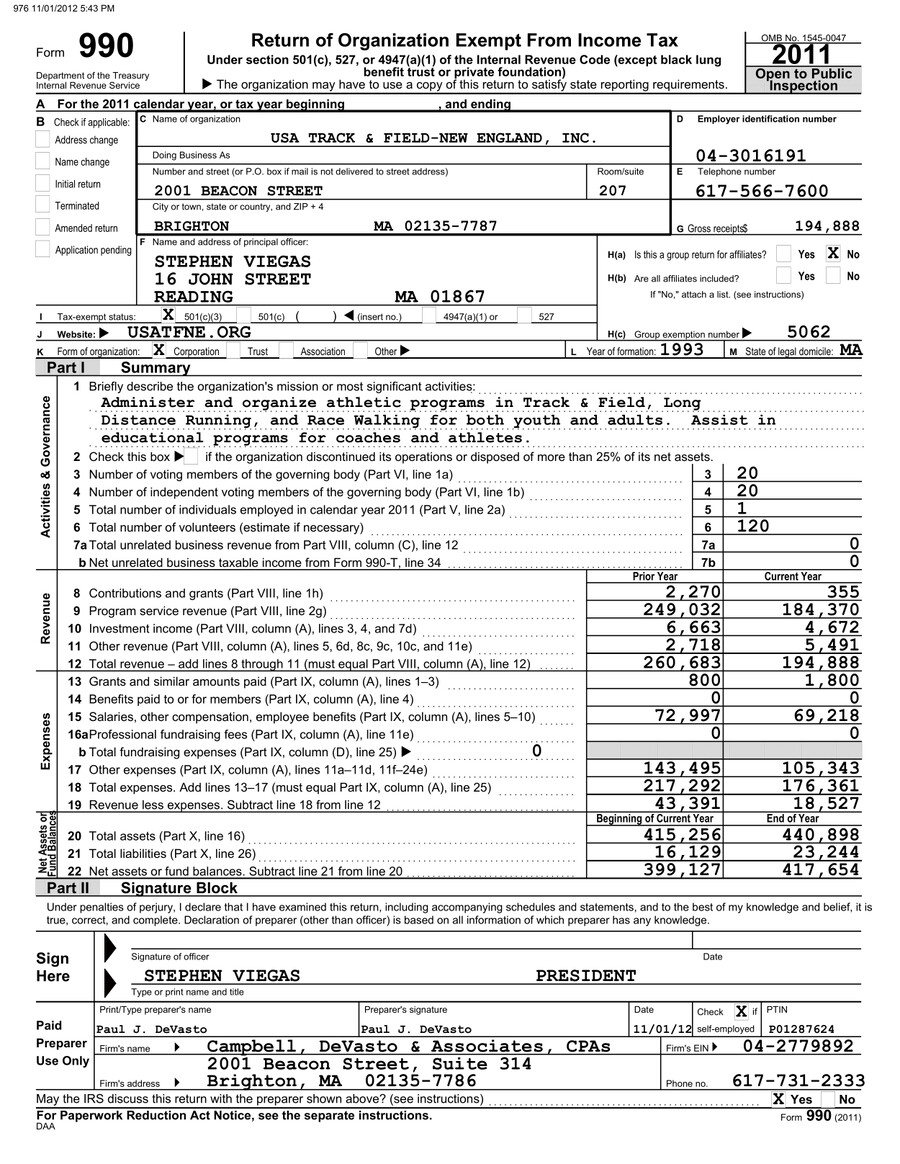

Less than try a map proving the present pattern between your SORA rate and you will Fixed Deposit Price that DBS mortgages simply take source from:

Towards the discharge of the DBS Simple Button mortgage, assets buyers now can enjoy the stability off a predetermined Put Price labelled bundle, plus the autonomy to improve to a pre-computed 3M SORA bundle for their possessions before Most useful. This personal package includes 2 100 % free conversions (1) so you can a predetermined 3M SORA package through to the issuance of top, and you can (2) to a prevalent plan of one’s customer’s choice from your collection off bundles, once Greatest.

Mortgage repayment Strategies

There are two main preferred mortgage payment systems to possess BUC attributes and you can these represent the Modern Payment System and the Deferred Percentage Plan. Per possesses its own has and you can qualification requirements.

Progressive Payment Design (PPS): It relates to payment of the instalments (typically 5-10% of the home purchase price) if framework of the home reaches pre-laid out milestonesparatively to possess selling condos, you ought to build a twenty-five% deposit and commence your month-to-month costs straight away.

Developers regarding private assets typically proceed with the progressive commission schedule set out-by the newest Houses Builders Rules. While some variations would be enjoy, brand new commission plan is always literally a comparable.

https://paydayloancolorado.net/ken-caryl/

A definite benefit of the latest PPS is the down initially month-to-month costs. Even when the designer was late within the getting the house or the brand new milestones aren’t attained, the loan money do not boost. If you are repair a mortgage, they will and additionally be less of the latest burden out of investment each other services at the same time.