If the costs get smaller, which can open the gates in regards to our student loan refinancing organization and you may our home finance providers, that’s tiny immediately

Improved liquidity and you can enhanced need for large-producing property once the pricing come down would be a huge tailwind towards team total. In advance of SoFi grabbed their legs off the gas close to the avoid of 2023 to wait from the macro turbulence, their personal bank loan originations for every single cash advance loan Kellyton representative was in fact really regular. It takes a few residence to find out in the event the originations could possibly get straight back up to $500+ out of originations for each associate where they certainly were to have 2021, 2022, and more than out-of 2023. But not, when they would, upcoming funds gains out-of unsecured loans often speeds exponentially since user development continues the rapid gains, which gains will be motivated from the financial support-light money away from loan transformation. Overall, the degree of money you to definitely SoFi starts are miniscule compared to the the amount of money requisite round the finance companies and investment professionals, nonetheless it nonetheless is still around seen if they see adequate consumers for those financing attractive sales rates. The chances to find those customers more than doubled now. This might be something to display screen along the next six-nine days. If the SoFi may returning to all of the $550-$600 within the consumer loan originations each associate diversity, we shall see volatile development in the financing phase.

College loans and you can lenders both have a similar active. Really, demand for student loan refinancing and home loans (one another refinancing, the new purchases, and you will family guarantee credit lines (HELOCs) have a tendency to rise while the rates slip. This new housing industry has had a hit which have value at all-day downs. Similarly, government student loan rates was greater than they truly are for the twenty years. Origination quantities to possess student education loans and all of style of mortgage brokers increase due to the fact prices flow off. A reduced and you will regular circulate down right here often cause good much time and you can long-term tailwind because consult slower develops and you can membership continues to grow.

A number of the most significant players throughout the student loan business, such as Discover and you will CommonBond, has completely exited the bedroom over the past 10 years. Recently, Navient is banned from repair government college loans recently as well. SoFi stands to benefit greatly about diminished competition. It seem to be the biggest pro from the space, and that i believe the share of the market is only going to build.

Student loans

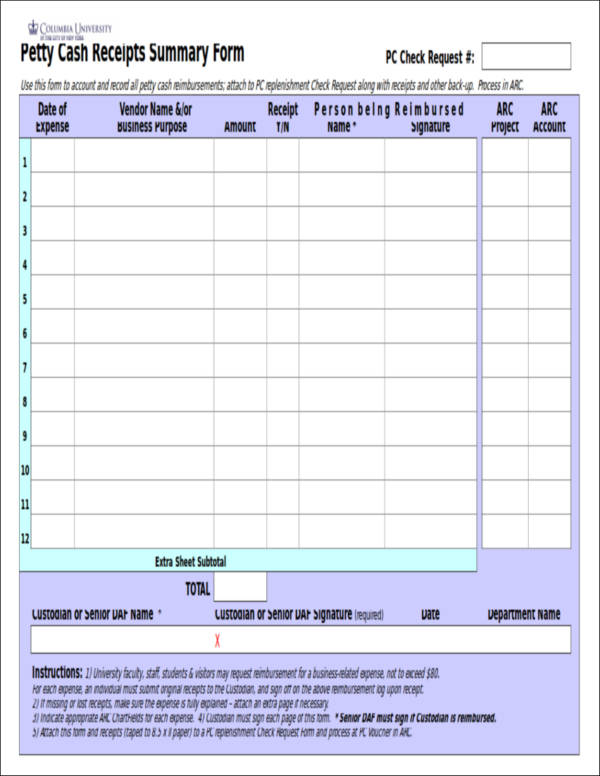

Prior to SoFi received their lender rent within the Q1 2022, they’d offer all of their college loans contained in this on the step three-half a year out of origination. Here are originations compared to mortgage transformation for the previous 3 many years approximately. The mixture of one’s financial rent and you will rising cost pressed SoFi to the a position in which they decided to hold loans for longer, and this this graph makes most visible.

Brand new immediate real question is why should SoFi want to forego the fresh huge difference into the attention and place student loans to their balance sheet? As to the reasons actually originate student loans whatsoever if the pricing try very lower on it? Why don’t you go after Come across and you may CommonBond out of the tool? I get which concern right through the day out of each other bulls and you can holds therefore I’ll give my address temporarily.

I don’t think some body see the education loan organization. Defaults are very lowest and also the financial obligation is amazingly difficult to discharge. It does actually pursue borrowers owing to bankruptcy proceeding. As such, figuratively speaking represent extremely low-exposure property. This is actually the annualized websites charge-out-of rate out-of student loans versus personal loans. And delinquencies, which happen to be a leading indication so you can non-payments, went down past one-fourth, so 2Q24 could be the maximum annualized mortgage education loan default speed in the years ahead.