Ca Va loan limitations gamble an integral character in the act from bringing home loans so you’re able to productive armed forces provider users otherwise men and women with in the past supported all of our country. Va mortgage brokers inside the Ca is mortgage brokers provided with mortgage companies in order to mortgage candidates in the California, additionally the Virtual assistant (Veterans Issues) guarantees the main financing. 1 It make certain in the Va allows a mortgage providers so you’re able to promote loans so you can veterans from the reduced words.

Exactly what are California Va Mortgage Constraints?

Ca Virtual assistant loans Napier Field AL loan limitations are certain numbers that loan candidate is also obtain within this a certain condition. You will need to remember that Ca experts that have full entitlement are not susceptible to these limits per the newest Blue-water Navy Vietnam Pros Work out of 2019. 2 If financing candidate is approved for full entitlement and you can the mortgage number is over $144,000, following Ca Va mortgage limits was waived because of the mortgage company.

Per Pros Points, the borrowed funds limit is founded on the amount the brand new Virtual assistant will guarantee (i.age., the absolute most they’re going to spend into the bank in the event that a loan candidate defaults with the that loan). 3

Full Entitlement Informed me

Entitlement ‘s the number brand new Va will make sure and shell out in order to the lending company if a veteran defaults on the financing. A california veteran which have complete entitlement is eligible for the whole amount new Va will make sure. Extent is actually both $thirty six,000 or twenty-five% of your amount borrowed. All of the California Va funds understand this requisite.

So long as the mortgage candidate qualifies various other parts (such as for instance money), there is absolutely no California Virtual assistant financing limitation to have veterans having complete entitlement.

California Virtual assistant Limits Because of the State

To have experts who don’t features complete entitlement, here you will find the Ca Va limits by the condition. These types of constraints are used to regulate how far that loan candidate which does not have any full entitlement is use just before choosing whenever they have to bring an advance payment.

Full Entitlement Qualification

You should be eligible for complete entitlement to quit the latest Ca Va mortgage restrictions. Really loan applicants might possibly be entitled to complete entitlement, together with those people to buy a house for the first time. This is what is needed:

- The borrowed funds candidate never ever used their Virtual assistant entitlement benefit, or

- Obtained repaid an earlier mortgage entirely and you may ended up selling the house, or

- That loan applicant had a foreclosures and you will paid off the mortgage when you look at the full

Provided the loan applicant suits among the significantly more than conditions, that loan candidate is eligible to possess full entitlement. 4 The last devotion commonly slip through to the lending company, who can proceed with the pointers approved from the Va. For those who have questions relating to your own Va entitlement, delight definitely ask your loan officer.

Bringing eligible to a california Virtual assistant loan is an easy, step-by-action processes. Before getting accredited, you should favor a top-rated large financial company and a loan administrator which have at least five many years of experience. Plus, if you aren’t qualified to receive complete entitlement, make sure you comply with the fresh Ca Virtual assistant loan limit to have your condition.

Obtain Their Price

The first step of getting eligible to a ca Virtual assistant financing is to get a quote and you may review the brand new terminology. A couple of trick section we need to pay attention to certainly are the interest and also the full amount of charges are energized (to own everything you). Of many loan providers only estimate a few of the costs getting energized, such lender charge, and so they omit third-group charge and you will, sometimes, disregard circumstances.

How to strategy this can be to ask, Which are the total charges to have what you? Asking precisely what the complete charges try puts your from inside the a much better status to know what was being quoted.

You will also need certainly to be sure your loan number matches your county’s California Va financing restriction (if you don’t have complete entitlement).

Finally, you’ll want to query the mortgage officer whether they have cited a speeds centered on a thirty otherwise 40-five-day lock. Even if you are thinking about not locking your rate of interest immediately, you still need the brand new quote as considering a thirty or 40-five day secure.

The reason is so it: a bid according to a rate that’s not lockable is not a precise estimate to look at as you have so you’re able to secure they at some point in process.

Finish the Loan application

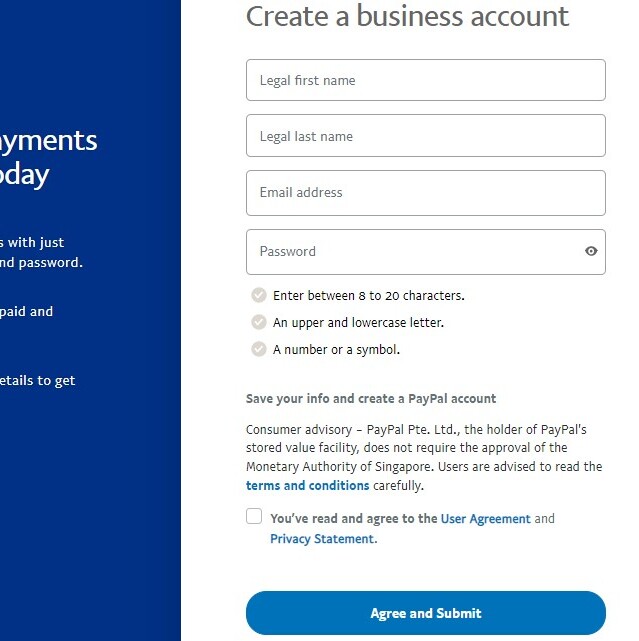

If you need new quote as well as the loan administrator possess demonstrably discussed all the charges, you ought to following complete the application for the loan. With most people, you could potentially complete the application for the loan to the cellular phone otherwise on line, and it also needs from the 10 to 15 moments to complete. Accomplish the loan software, you need another first pointers;

- If it’s a buy, the property target of the home you will be to buy

- Information that is personal eg name, target, big date off delivery, social shelter number, etc.

- A job advice

- H2o advantage information (i.e., checking account)

Submit Your own Files

As soon as your loan application is done, you will have to turn in the files. Is a basic selection of documentation you will have to upload toward financing manager:

- Earnings files

- H2o investment papers

Consult with the loan manager what particular circumstances you will have to send in and in case any extra points could well be needed. When turning in your own paperwork, make sure the records is clear and you may done (meaning all the users are included).

Underwriter Recognition

If for example the mortgage officer has had your own finished application for the loan and you can your required files, they’re going to posting their document on underwriter to have the full review. Ahead of undertaking that, the mortgage manager is to verify that your loan count match your own county’s California Va loan limitation amount (if you don’t have complete entitlement).

Three Parts The brand new Underwriter Is targeted on

Your file must meet the requirements for these three components. If you don’t have full entitlement, the fresh new underwriter must also confirm that you do not exceed their county’s Ca Virtual assistant loan restrict. Should your application and you may paperwork meet with the underwriting criteria, your own underwriter will approve your file and you will question standards to have closure.

Review the fresh new recognition and you can closure conditions with your loan officer very you could potentially proceed that have finalizing mortgage documents and you may closing their financing.

Final State Into California Va Loan Limitations

The Virtual assistant loan system is a superb substitute for consider in the event the you are in the fresh military or have offered.

For people who get a beneficial Virtual assistant financing, the fresh Virtual assistant will make sure to twenty-five% of residence’s value (given the loan balance was at or above $144,000). So it collateral guarantee allows lenders giving discounted conditions into Virtual assistant finance plus a no-deposit alternative. Without having full entitlement into Virtual assistant consequently they are buying property inside California (or mortgage refinancing), you will need to follow your own county’s California Va financing restriction.