What’s Freddie Mac computer-Government Financial Home loan Corp. (FHLMC)?

This new Federal Mortgage Home loan Corp. (FHLMC) try a stockholder-had, government-sponsored business (GSE) chartered by Congress for the 1970 to save money moving so you can financial lenders, which helps homeownership and you can local rental housing to possess middle-income People in the us. The FHLMC, familiarly known as Freddie Mac, orders, guarantees, and you may securitizes home loans which is a mainstay of the secondary financial market.

Key Takeaways

- Freddie Mac is the theoretically accepted nickname on Federal Domestic Loan Mortgage Corp. (FHLMC).

- Freddie Mac computer is a shareholder-possessed, government-paid organization (GSE) chartered of the Congress in 1970 meant for homeownership having middle-income People in the us.

- Brand new character out-of Freddie Mac is through buying a great deal of funds away from mortgage lenders, then mix them and sell him or her as mortgage-backed securities.

- Fannie mae and you will Freddie Mac is actually one another in public exchanged GSEs. An element of the difference between her or him is that Federal national mortgage association purchases financial finance off biggest shopping otherwise commercial banking institutions, if you find yourself Freddie Mac gets the money regarding shorter banks.

- Some has actually contended you to unchecked development to possess Federal national mortgage association and you can Freddie Mac was an effective pri you to turned into the great Market meltdown.

Reputation for Freddie Mac

Freddie Mac is made whenever Congress introduced brand new Emergency Family Funds Act within the 1970. A wholly had part of the Federal Home loan Bank operating system (FHLBS), they depicted a you will need to get rid of interest rate exposure to have savings and you will finance connectivity and you can faster finance companies. During the 1989, beneath the Financial institutions Change, Recovery, and you can Enforcement Act (FIRREA), Freddie Mac undergone an excellent reorganization. They became an openly had organization, which have offers that could exchange with the Nyc Stock-exchange.

Within the 2008, for the economic crisis stimulated from the subprime home loan meltdown, brand new You.S. government-particularly, the brand new Government Construction Financing Agencies-grabbed over Freddie Mac. Even in the event it’s gradually transitioning toward liberty, it stays lower than government conservatorship.

Precisely what does Freddie Mac computer Carry out?

Freddie Mac computer was created to help the flow away from borrowing so you can various areas of the cost savings. And additionally a comparable GSE, Federal national mortgage association, its a button member on secondary home loan sector.

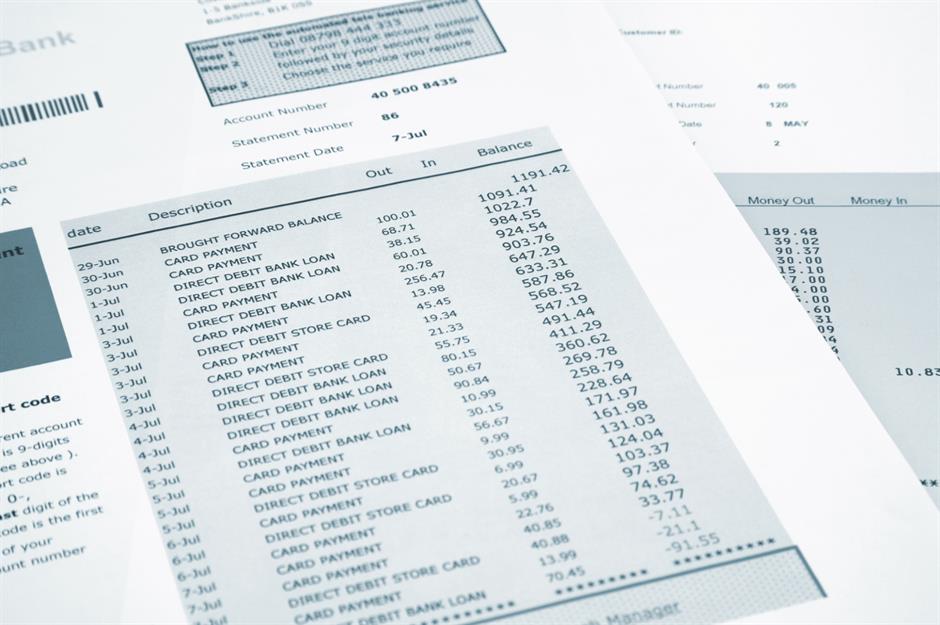

Freddie Mac cannot originate or solution home mortgages by itself. As an alternative, they https://paydayloansconnecticut.com/candlewood-shores/ buys lenders regarding financial institutions or other industrial lenders (offering this type of institutions finance that they may upcoming used to money far more finance and you can mortgages). These financing must fulfill particular criteria that Freddie Mac set.

Just after to order thousands of such mortgages, Freddie Mac computer often retains them in its own collection otherwise combines and deal him or her given that mortgage-supported bonds (MBS) so you’re able to people who’re seeking to a reliable income stream. Anyway, it “insures” these types of mortgages-that is, they guarantees the fresh prompt commission of dominant and interest into the finance. Because of this, bonds provided by the Freddie Mac computer are extremely h2o and carry a credit rating alongside regarding You.S. Treasuries.

New part of the U.S. home loan originations (which is, the latest fund) securitized and you will protected of the Freddie Mac computer as well as sister business, Fannie mae, by mid-2020.

Problem regarding Freddie Mac computer

Freddie Mac has arrived significantly less than ailment once the their ties towards U.S. government give it time to borrow money at rates of interest below the individuals accessible to almost every other creditors. Using this money advantage, they factors large amounts off financial obligation (known around once the service debt or agencies), and as a result requests and you may retains a giant profile from mortgages labeled as its chosen collection.

Some people believe that the dimensions of the fresh new chosen profile shared toward intricacies of controlling financial chance poses much out of medical exposure on the You.S. benefit. Critics has debated that the unchecked development of Freddie Mac and you may Fannie mae lead to the credit crisis of 2008 that plunged brand new You.S. with the Higher Recession. (In response, advocates of your own businesses argue that, if you find yourself Freddie and Fannie generated crappy company behavior and kept shortage of financial support into the casing ripple, its portfolios made-up merely a fraction out of full subprime finance.)

Fannie mae and you can Freddie Mac’s single-members of the family foreclosures moratorium, applied due to the 2020 overall economy, finished toward . However, a residential property had evictions is actually halted up until s remain. People that have mortgage loans is subscribe and you may pause its repayments for up so you’re able to per year; people that was basically signed up as of , will get be eligible for around 18 months. Almost every other borrowers is generally entitled to that loan amendment.

Freddie Mac against. Fannie mae

Federal national mortgage association (Fannie mae or FNMA) was made from inside the 1938 as an element of a modification toward National Homes Act. It was believed an authorities service, and its own role would be to try to be a holiday home loan industry that will get, hold, otherwise offer fund that have been covered from the Federal Homes Management. Fannie mae stopped becoming an authorities agency and you may turned an excellent private-public firm beneath the Constitution Act out-of 1954.

Fannie mae and you may Freddie Mac computer are extremely comparable. They are both in public areas replaced businesses that was basically chartered in order to suffice a beneficial personal purpose. An element of the difference between the 2 relates to the cause of mortgages it get. Federal national mortgage association buys mortgages from significant shopping or industrial banking companies, when you are Freddie Mac gets its fund out of less banking companies, also known as thrift banks otherwise savings and financing associations, that are focused on taking banking services so you’re able to groups.