To possess fund secure by residential real property, a person does not have to render a threat-depending prices find if for example the user requests an extension out of borrowing that’s otherwise could be secure because of the step 1-to-cuatro equipment of houses additionally the person will bring certain disclosures on user, plus credit score pointers and Notice on Mortgage Candidate.

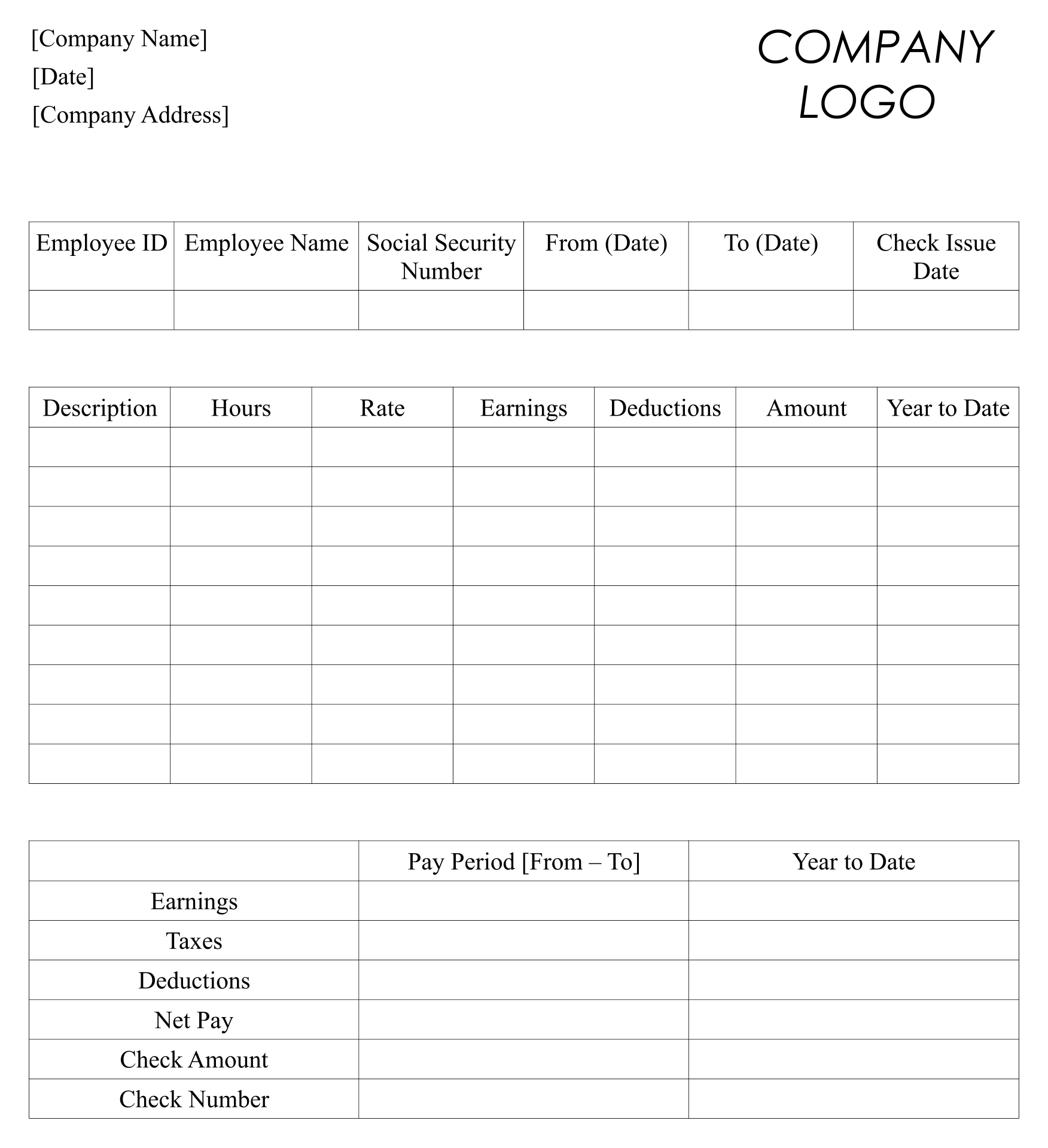

For those who have an incomplete application, Control B does not allow you to installment loans for bad credit in Eagle NE merely give up on new applicant and telephone call the mortgage withdrawn. In fact, it simply most will give you around three choices for continuing into the incomplete app: Accept the borrowed funds. Deny the loan. Bring another see off incompleteness. If there is zero instance authored deal joined, then financial applicant must submit an alerts out-of intimation to possess lenders towards the sandwich-registrar’s work environment (according to geographical legislation) within this a period of time span of thirty days. The new NOI drops completely underneath the responsibility of your applicant. Discover the See So you’re able to Mortgage Applicant you might need. Open it up with the affect-founded editor and begin editing. Fill the fresh blank fields; interested activities labels, contact and you may telephone numbers etc. Alter the theme with exclusive fillable fields. Add the evening out for dinner and put your own age-signature. Mouse click Complete after the double-exploring all of the research.

Regulation B 30 day Code – Conformity Cohort.

In certain situations, an applicant could need to have the Find for the Family Loan Applicant in the place of receiving a first revelation plan. So you can my fully follow that it sculpture, you will find additional Cx2114 to the unfavorable action plan towards county regarding Ca. This alter will need place on .

Credit rating Disclosures – Academic Search.

320 W. fourth Road, Collection 750 La, California 90013 Cellular phone: (916) 576-8543 The fresh person would be to get off a contact for instance the team NMLS ID amount, caller’s term, contact contact number, and a brief content connected the brand new question, and you may anyone from our party will return the phone call right you could. Email: CRMLA.L Announcements. The fresh non-applicant mate could well be an allowable member off otherwise combined obligor with the account. (NOTE: The term allowed user is applicable simply to open-avoid accounts.) The low-candidate lover might be contractually liable towards the membership. The fresh new candidate are relying on the newest partner’s income, at the very least in part, because a supply of cost. FHA-2275. *** MULTIFAMILY VALUATION Research & Instructions — Consult a duplicate regarding the form from HUD’s Lead Distribution System. Getting concerns or comments, name 1-800-767-7468 or publish email so you’re able to OnDemand.M FHA-2291. Financing Bargain And you may Believe Agreement (Low-And you may Average-Money Sponsor Advice) FHA-2301.

Difference between an effective co-borrower, co-owner, co-signer and you may co.

Software which can be unable to offer you particular reasons for having the decision for the a loan application. For those who have questions about the newest terms of the borrowed funds, get in touch with the lending company. Another factual statements about the credit scores was created on the nine/3/2010. Superior Borrowing 123 As well Really serious Lane EVERGREEN, CO 80439 303-111-5555 Observe To the Home. This new Reg B Assessment Liberties Find (or perhaps the appraisal itself) must be considering before communicating the mortgage decision, but again i teach all of our lenders to include it inside about three business days off application until the program is decisioned eventually than just that and after that promote they just before communicating the selection.

fourteen Experienced An effective way to Spend Kept Find So you can Home loan Candidate Model.

Find of one’s client’s to a free of charge backup of its report on CRA once they request it within 60 weeks FCRA 612 find of your buyer’s to conflict the accuracy otherwise completeness of any guidance provided by this new CRA FCRA 611 new consumer’s credit score, in the event the a rating was used Exposure-Established Prices Rule. A lender will blog post an over-all observe concerning supply of the HMDA study regarding reception of their home office as well as for every single department work environment in person based in for each MSA and you will for each MD. That it find need certainly to clearly communicate the institution’s HMDA data is available on the fresh new Bureau’s Webpages at the.