By providing the lending company having a home, an auto, a bicycle, a beneficial van, or anything else of value, anyone with less than perfect credit can obtain a personal loan in place of a credit assessment. You must know bringing guarantee whenever you are looking for it kind of mortgage. Whenever a borrower uses guarantee, brand new feeling out-of borrowing from the bank on his or her credit history is mitigated; however, the latest borrower’s failure and make timely payments nevertheless places the fresh borrower’s equity at stake.

Zero. You won’t ever manage to sign up for a loan that are certain to getting recognized, regardless of how rapidly the fresh new recognition process moves along, what kind of personal loan your apply for, otherwise how well your borrowing are. It is because there are not any loans that are protected.

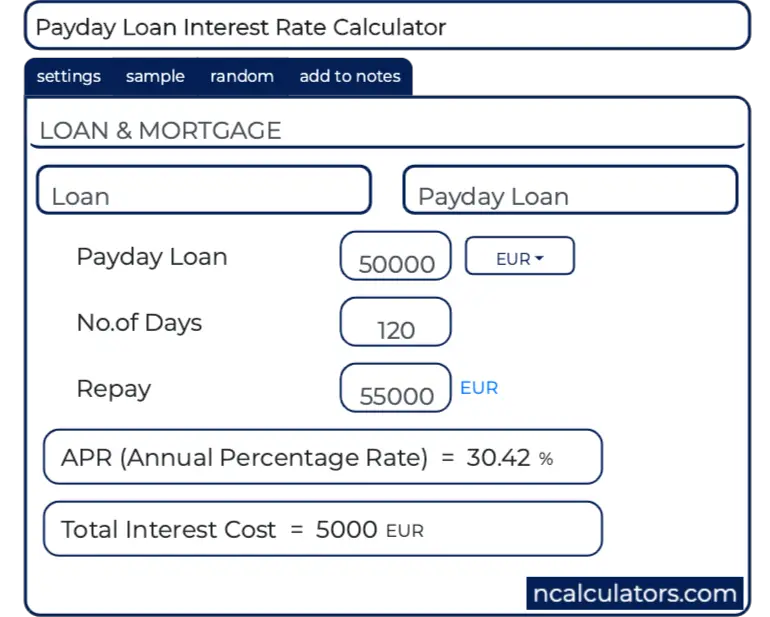

Stop without exceptions payday loan brokers and you will unethical loan providers exactly who verify loan acceptance. Loan providers which offer payday loan end up in this category.

Do i need to predict you to lead lenders cannot would a credit evaluate?

Sure. DimeBucks can help you see lead loan providers private finance actually if you have poor credit because they only would a tiny amount of borrowing checks.

A loan provider may create an effective flaccid inquiry whenever deciding whether to grant you that loan. Borrowing checks is also lower your rating. Flaccid credit inspections you should never affect your own rating.

‘s the interest rate into the poor credit financing highest?

Yes. There clearly was exposure on it when taking aside financing, however, you to risk expands somewhat should you too possess less than perfect credit and you may inconsistent earnings.

Inability to expend your own debts timely personal loans with no bank account required simply increase your personal debt and you will spoil your credit rating, so it’s more complicated to getting funds from the coming. It will be easy you to filing for bankruptcy proceeding is your sole option to own an economic fresh start.

You should invariably exercise alerting whenever obtaining fund and continue maintaining a close eyes on your own credit history, past-owed expense, or other monetary issues. You could potentially stop the risks by doing this.

How important could it be having crappy-credit individuals having a steady occupations before you apply to have good mortgage?

- a bona fide checking account which is used to have transactions

- Obtaining You Citizenship

- Othan possess turned into 18 and that’s now a grownup.

- getting the monetary means to repay bills

- Per month, an average of $800 or maybe more are gained.

DimeBucks: What is the process of a less than perfect credit application for the loan

For individuals who click Begin, you’ll end up taken to the on the web application, where you can get into your details (such as your decades, area, loan amount, loan duration, money, and you may costs) and get a choice right away. DimeBucks have an on-line software that you can use.

The audience is that loan complimentary services, therefore we will get you the best interest rate and words out of a loan provider that will take on the job. For people who take on the first bring, your earnings and you can capability to pay back the mortgage could be searched again. When you find yourself approved, the money would-be on your membership in this an hour or so, a comparable working day, and/or 2nd working day.

The services is free of charge nowadays and always might be. Just like the i work tirelessly to find the best poor credit financing options for our users, using that have DimeBucks will not hurt your credit score.

Just how soon are you willing to handle fund getting individuals with terrible borrowing from the bank?

DimeBucks also offers brief financing to the people that have less than perfect credit into exact same time, next working day, otherwise contained in this days. Some of the finance was indeed signed inside an hour or so to be acknowledged.

Low-attention, unsecured loans are generally provided automatically in line with the borrower’s earnings, credit history, and you will capacity to repay. As a result, the process may be a lot faster, while e big date.