Your own personal situations and you can ability to pay off the mortgage should determine if we need to proceed which have a bridge loan otherwise a HELOC.

A HELOC, on the other hand, has the benefit of offered words getting cost if not trust you are in a position to repay the mortgage in full instantly. Do your homework before you apply as different loan providers offers varying selection and you will criteria.

You will want to guess future costs that’s incurred. New link mortgage, including, will assist in providing the 20% down-payment you want for your house.

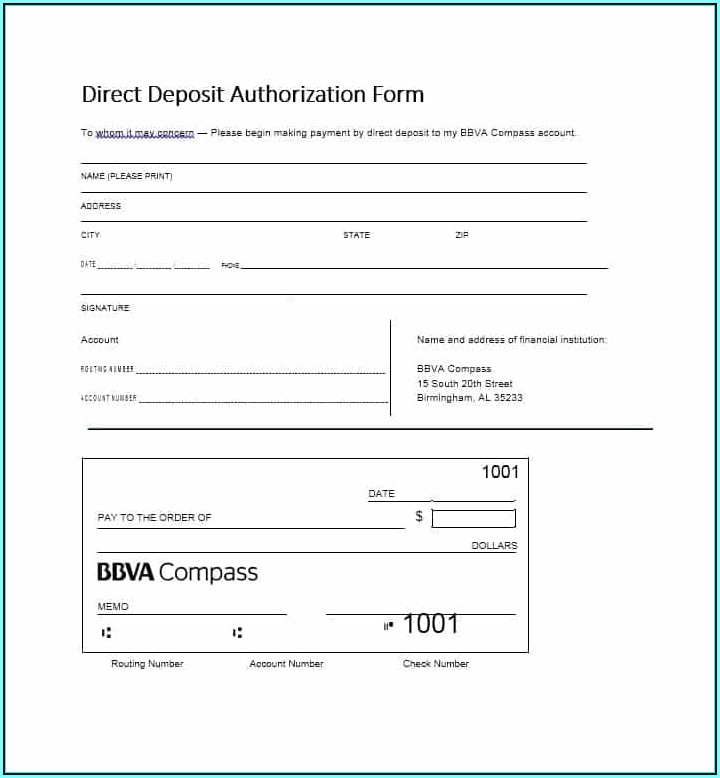

Any kind of choice you will be making, whether or not a bridge mortgage otherwise hop over to the website a beneficial HELOC, Compass Financial can be obtained to help you make the proper choices

Yet not, when you have some funds arranged for the deposit but must pool some extra loans, a beneficial HELOC could be a far greater alternative. Their coupons and a smaller sized loan helps you come up thereupon 20% down-payment.

HELOC might be a faster, less expensive solutions outside of the a couple, particularly if you possess lots of security of your home.

Whilst the financial will theoretically allows you to borrow secured on any sort of resource you possess, including your 401(k), the newest HELOC could be the simplest otherwise establish the latest smallest path for those who have sufficient guarantee.

The brand new HELOC could be the ideal financial options once the appeal price toward a bridge financing mortgage might possibly be higher than it might be to your a routine home loan. When you find yourself a link financing can an important equipment getting short-name financing, it may be more pricey overall, so there may be extra can cost you that consist of dos-4 %.

Make the right solutions having Compass Financial

The experienced and you can enchanting people is preparing to help you get pre-recognized, pick an alternative domestic or tap into your home’s collateral.

Looking for to increase, otherwise circulate down but your downpayment are tied to the brand new security on your latest family? Connection Finance is a problem at this time with inventory being very tight.

Purchase Link Loans: are utilized whenever a borrower desires pick another possessions prior to offering the current assets. The borrowed funds provides temporary resource to cover buy before selling of the newest property is signed. Since the sales is done, the brand new debtor pays off the link loan.

In the New Mortgage we aren’t a bank, our company is separate lenders that work for your requirements, the folks, and then we have quite a few options to own connection financing and which awesome 0% appeal real bridge financing.

Well even as we provide pre-approved to purchase your new house, we fill in several parameters in the bridge loan so you’re able to see how much currency we could remove of your own most recent house. You could potentially obtain doing 80% of the value of your property plus the interest to possess the mortgage is actually 0%. It means if you find yourself into the escrow, purchasing your new home, this mortgage wouldn’t connect with the debt-to-money proportion.

Therefore, let’s only use an example of a home really worth 1M. and allows state you’ve got an initial financial regarding five-hundred,000. This would release $three hundred,000 inside dollars to make use of since the a down-payment in the for the your brand-new home.

Next as soon as we personal escrow on your own brand new home, you’ve got ninety days to offer the existing home. With directory being so rigid when you look at the Ca, which is enough time to offer you home on an excellent maximum value.

Recall, you will not getting way of life indeed there, to help you stage the house and really obtain it in the its top product sales worth without having any worry off offering earliest and you can renting, or swinging twice etc.