Whenever Karissa Warren shed the lady business due to the fact a kitchen area movie director in December, she concerned with exactly how she and her spouse perform still repay more than $10,100 in personal credit card debt they had built-up throughout prior economic harsh spots.

Worsening the issue, highest inflation had hiked the brand new couple’s informal costs, along with products because of their three-year-dated child, said Warren, 30, who lives in Silver Spring season, Maryland.

To simply help pay bills, she worried about her front side employment due to the fact a good baker, although dining cost made it very hard on her to help you turn a profit, she told you.

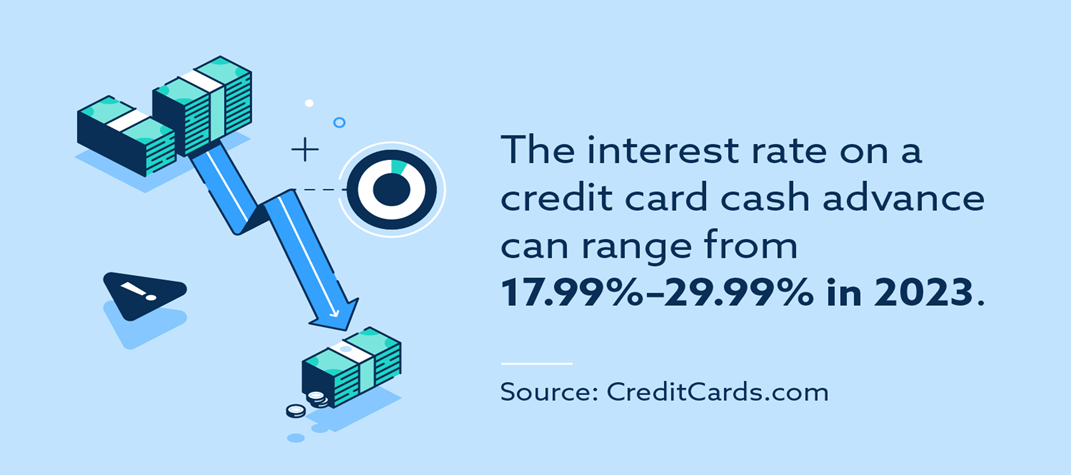

In addition, interest levels towards couple’s bank card enjoys skyrocketed. Around 2 years in the past, Warren and her partner consolidated its loans on a single card, and therefore considering 0% attention with the first year. This may be ticked as much as 5%. In recent months, one to price has actually twofold to 10%, Warren said.

MORE: Provided approves 0.25% hike, softening price expands once more

Warren is among the most of numerous Americans battered because of the a single-one or two financial punch off raised rising cost of living, which has delivered home expenses soaring; alongside aggressive rate of interest hikes, that have spiked charge card pricing and you can interest levels to other finance that help safety new ballooning costs.

The latest drawback you will definitely diving particular home towards the debt for years, while they struggle to generate costs one retain the rising rates, advantages said.

The typical bank card representative sent a balance from $5,805 in the last 90 days off 2022, lookup organization TransUnion found. The contour noted an enthusiastic eleven% improve on the year previous.

The fresh new Provided has submit a set regarding borrowing cost expands since it tries to reduce price nature hikes by the slowing the fresh cost savings and you can choking out-of consult. Meaning individuals face large costs for many techniques from auto loans to personal credit card debt so you can mortgage loans.

“Because Provided has been elevating costs aggressively over the past year, that truly have an immediate move across on charge card price,” Ted Rossman, a senior expert on Bankrate whom centers on the credit credit world, told ABC News.

MORE: Tech layoffs 2023: Firms that have made slices

“People may not have enough income arriving to help with date-to-date costs, it places towards charge card,” the guy additional. “You to definitely becomes an incredibly persistent period regarding financial obligation, unfortunately.”

The average mastercard rate of interest offered in the newest U.S. within the last 3 months regarding 2022 endured within 21.6%, considering WalletHub, a bounce away from 18.2% a-year prior.

At the same time, the fresh share men and women with ongoing charge card funds has grown. The latest proportion off charge card users exactly who bring an equilibrium has increased to 46% from 39% this past year, Bankrate receive.

At the same time, house looking rest from highest rates have observed a keen easing out of rising cost of living can you get a loan with no state id, however, rate increases are nevertheless surprisingly higher.

Consumer cost flower six.5% over the yearlong several months conclude inside ounts to a life threatening slowdown out-of a summer peak but stays more than triple the latest Fed’s address rising cost of living price off dos%.

Speed hikes for the majority things sit well above the total rising prices price. The price of egg has actually increased 60% for the past 12 months; since the price of flour has actually increased 23%, government data presented.

“The fact that you are expenses more so you can fill the cart having goods, so you can fill your vehicle with gasoline — that is yourself resulting in so much more investing and loans,” Rossman said.

MORE: ‘I’m however shocked’: Technology specialists offer insider membership off size layoffs

Paula Eco-friendly, sixty, a gig worker raising the lady fourteen-year-old grandchild, plunged $cuatro,five hundred on personal credit card debt into the November shortly after spending thousands into the girl daughter’s wedding. The interest rate on her behalf cards, %, designated an increase in the rate on the credit days in advance of, she said.

Instead of afford the obligations from apparently easily at about $500 a month, Eco-friendly features the amount of time 1 / 2 of as often so you’re able to spending it down due to the fact she weathers rising cost of living, she said.

“This has impacted me dramatically,” told you Environmentally friendly, who lives in Rossville, Illinois, an urban area a couple of hours southern area out of Chicago. “It has got turned into my personal funds on the their head.”

The expense of dinner to have Environmentally friendly along with her grandchild has actually popped somewhat, she told you. An excellent a dozen-pack off diet plan Coke costs Eco-friendly $six.99 before pandemic, she told you; now it will cost you double one to.

Environmentally friendly, who may have has worked self-employed since the 2009, try training to have a customer support employment in the a sail range organization discover a great deal more reliable income as she confronts about 2 years out-of credit card debt, she said.

MORE: What you should discover Biden offer to reduce charge card late fees

Warren said she actually is performing a separate work in the future one to pays over the one that applied the girl of. The woman is hoping the added money will assist the girl along with her spouse pay back their credit debt contained in this a couple of years, and finally pick a property, she said.

Rising cost of living have a tendency to smoothen down over the coming years, eventually reaching regular accounts, benefits said. Nevertheless reducing away from pricing may need far more rate of interest nature hikes, labeled as financial toning, that produce borrowing from the bank can cost you and as a result mastercard pricing also higher priced for the time being, it additional.

“The question was: Just how much tightening can it test reduce the savings and you may bring down rising prices?” William English, an old elderly Provided economist and you can loans professor in the Yale College or university regarding Administration, informed ABC Reports. “It’s very tough to predict.”