Despite the challenges, mortgage options are available to those as opposed to a personal Safeguards Amount (SSN). People who need to pick property throughout the U.S. can look towards the International Federal mortgages.

What exactly is an enthusiastic ITIN?

These types of wide variety is actually for folks who aren’t entitled to discovered a simple Social Coverage Amount (SSN) however, have to document a federal income tax go back.

ITINs is actually granted so you’re able to one another resident and nonresident aliens-non-U.S. owners who live often into the U.S. limits otherwise beyond your You.S.

What is the aim of an enthusiastic ITIN?

The reason for an enthusiastic ITIN is to try to aid tax reporting and compliance for those who are not entitled to a social Protection Amount.

It is very important to notice you to definitely an enthusiastic ITIN is not sufficient authorization to operate in the united states. It also will not promote one immigration experts. Its strictly an income tax handling count.

The way to get a keen ITIN

The paperwork need certainly to confirm your own title and you may foreign condition. They usually includes a valid, unexpired passport or any other data including a delivery certification, license, or national identity credit.

- Post the new done mode and papers to your Irs

- Complete the form and paperwork yourself during the a specified Internal revenue service Taxpayer Guidance Center

- Play with an Internal revenue service-signed up Certifying Acceptance Broker (CAA) or an affirmation Broker (AA) to help for the app procedure.

It needs the fresh Internal revenue service ranging from six in order to 10 weeks so you can processes a keen ITIN application, following the new applicant gets a letter with the ITIN.

What’s an enthusiastic ITIN mortgage?

An enthusiastic ITIN loan is commonly called a different National financial or Overseas Federal financing. This can be a form of home loan loan specifically designed having homebuyers that do not have a personal Safeguards Number but i have a keen ITIN.

ITIN fund are thought non-conventional, definition they’re not backed by bodies businesses eg Fannie mae, Freddie Mac, or the FHA.

Instead, ITIN funds are given of the personal lenders, financial institutions, and you can credit unions which can be prepared to extend credit to help you International Nationals.

Benefits associated with ITIN funds (Overseas National mortgage loans)

There are many positive points to a foreign National mortgage, especially for those who do not have a personal Shelter Matter.

Homeownership

Paying for home financing allows them to build collateral (age.grams., the main assets he has got purchased which will be legally theirs to utilize as the collateral) and expose root inside their community.

Credit history

Overseas Nationals will generate a credit rating on You.S. by the acquiring a mortgage and you may making prompt repayments. This is important since the majority homebuyers are unable to make whole buy into the dollars. Installing so it credit rating are going to be good for coming financial desires, such as for instance providing credit cards or providers loan.

Possible taxation positives

Depending on the person’s taxation disease, getting quick cash loans in Meeker a property on You.S. can provide tax pros, such mortgage desire deductions.

ITIN mortgage standards inside the 2023

- A valid ITIN: Just like the term means, borrowers need to keeps a legitimate ITIN awarded by Irs.

- Latest ID: A personal safeguards cards or green cards is not required. However, you may have to promote a license and other regulators-approved ID.

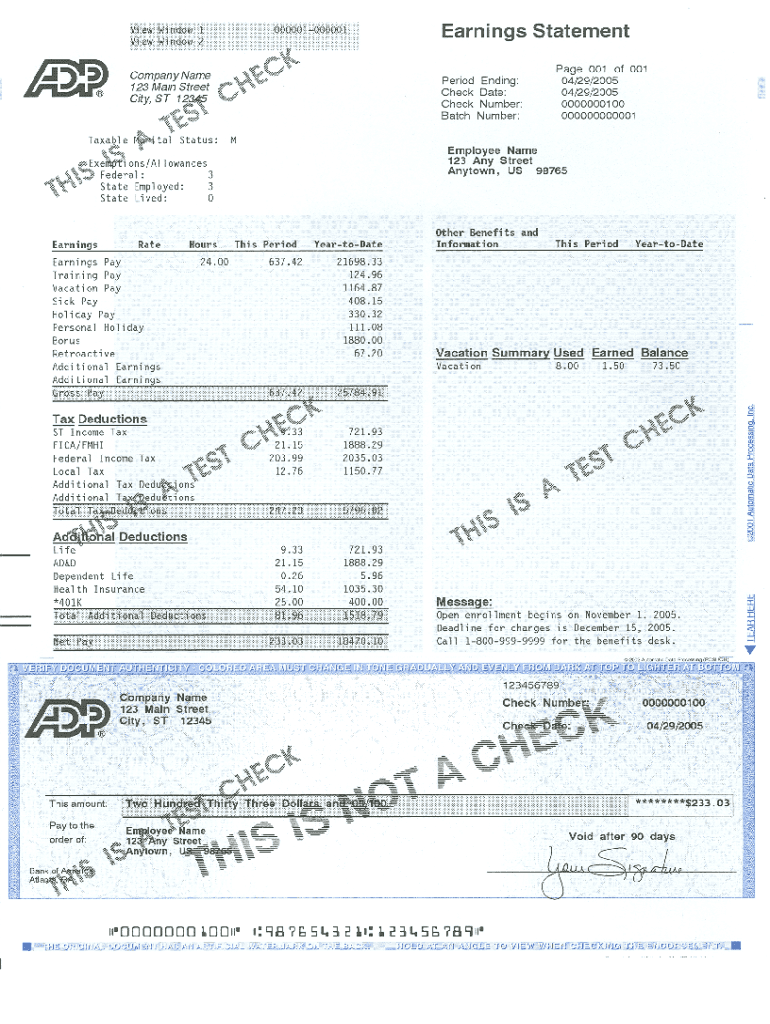

- History of filing fees towards ITIN: You must have 24 months away from recorded taxation statements below your ITIN.

- Enough money: Consumers need to show that he’s got a steady and verifiable origin of cash to pay for home loan repayments.

- A job background: Loan providers usually wanted a minimum of two years out-of carried on work, possibly with the same company or in an equivalent distinct really works.

- Down-payment: ITIN loans often wanted a down-payment anywhere between fifteen% so you’re able to 31% of your own cost. Overseas lender statements will need to be translated to help you English because of the the lender. Deposit financing must be changed into USD.