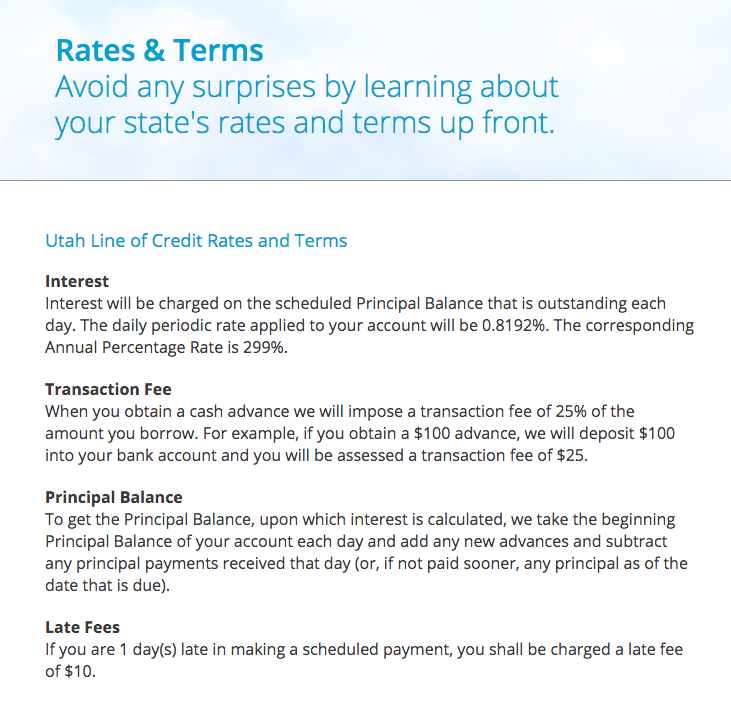

Graph 2

Notes: Adjusted quotes. This new CES gathers to the experimental basis even more investigation towards the households’ housing condition along with homeowners’ financial type in a great specialised component on the houses areas all of the February.

Highest interest rates and rising cost of living criterion

Very, what’s the thought of commitment ranging from consumers’ criterion on inflation and the requirement throughout the interest rates? Survey members who anticipate seemingly high interest levels generally also anticipate relatively highest rising prices pricing across the 2nd yearly (Graph step 3). This suggests you to definitely users never always anticipate large interest rates during the a period of economic plan toning to lead to reduce rising prices, no less than outside the brief. You to prospective reason for it self-confident relationship is that users you will in addition to expect loan providers to increase rates to pay for rising cost of living inside their lending factors. Yet another it is possible to cause of so it self-confident connection is the character away from rate-delicate home loan repayments, which have a visible impact to the consumers’ bills and you will raise their rising prices criterion. This means, higher interest rate requirement is a source of larger issues concerning the cost of living, being consequently reflected when you look at the rising prices standards. Which choice explanation is actually supported by the reality that the positive matchmaking between moderate interest rate requirement and you can rising cost of living expectations is most effective to have customers who keep a varying-rate mortgage and generally are ergo very met with alterations in desire prices (Chart step three, purple range).

Graph step 3

Notes: Weighted estimates. The fresh Profile illustrates a great binscatter spot of average intended imply of an effective beta shipment designed for users probabilistic forecasts from rising cost of living over the next 12 months (y-axis) against people interest rate traditional along the second 12 months (x-axis) according to pooled study. Each of the fitted contours makes up about private fixed outcomes and revolution dummies indicating and therefore the inside-individual upgrading out of requirement.

This new role off housing regarding indication regarding economic rules try and additionally mirrored inside the a growing divergence in the way properties understand its finances today than the 12 months ago according to the homes situation, specifically into nature of their financial package. This new show out of domiciles you to definitely select its financial predicament because weakening provides continuously denied due to the fact rising prices possess dropped from the peak within the late 2022. This new CES investigation also stress, although not, you to consumers that have varying-price mortgages was constantly more inclined observe its economic issues while the getting worse (tangerine line in the Chart 4). Additionally, certain houses have also struggling to service the mortgage repayments. In the event that amount of short-identity interest rates peaked in approximately fifteen% off varying-price mortgage people participating in the CES anticipated to getting later employing mortgage payments along side next 1 year. It contrasts greatly into 5.8% off repaired-rate financial owners with the same expectation.

Graph 4

Notes: Adjusted estimates. Every month, people are asked: You think all your family members try economically better off otherwise tough regarding today than simply it absolutely was one year ago? for the a level of Much worse out-of, A little even worse away from, About the same, Some best off otherwise Best from. Individuals are classified because the that have a tough financial situation once they respond to which have rather more serious out of otherwise quite worse out-of.

Within blogs, i show that when you look at the latest financial firming stage people modified the genuine rate of interest requirement. We also provide facts that tightening off monetary policy keeps come carried in loan places Sitka different ways to various euro city domiciles, to some extent reflecting the divergent houses and financial problem. Appearing ahead, a resetting of your own interest into the fixed rate mortgages and therefore began from inside the low-value interest period would suggest an excellent delay contractionary influence on euro area households at the already prevailing appeal costs. A virtually track of homes ents getting users, in addition to from lens off private-height domestic data, causes all of our comprehension of this new lingering financial indication.