Buying your very first domestic will be a good expertise in this new right pointers and also the right people in position. We are right here to simply help before you go towards the homebuying journey.

If you find yourself not used to the new homebuying process it may be tough to know how to proceed. What kind of earnings do you want to qualify for a mortgage? Which are the methods inside it? How do you independent fact regarding fiction? Our company is right here to help dismiss specific mortgage mythology and set you right up to achieve your goals.

Look outside the rate of interest

In contrast to that which you you are going to faith, their home loan interest rate is almost certainly not the first grounds. There are numerous quantity which go into the month-to-month home loan number and you will mortgage loan is only one piece of the fresh puzzle. According to price of our house a little difference in home loan interest rates might be manageable. Having a property costing $350k, for-instance, you may be deciding on an installment change of $a dozen to help you $25 four weeks for each and every .125% rise in the rate. However, remember that these number do sound right along the lives of the financing.

A few almost every other very important items may be the measurements of the mortgage your want to take out as well as how easily we need to spend it well. Your own will cost you would-be deeper the fresh new less of your budget you devote toward a deposit and also the offered the loan identity. Other variables that can effect their monthly mortgage payment were individual mortgage insurance coverage, assets fees, homeowner’s insurance policies and you can relationship fees.

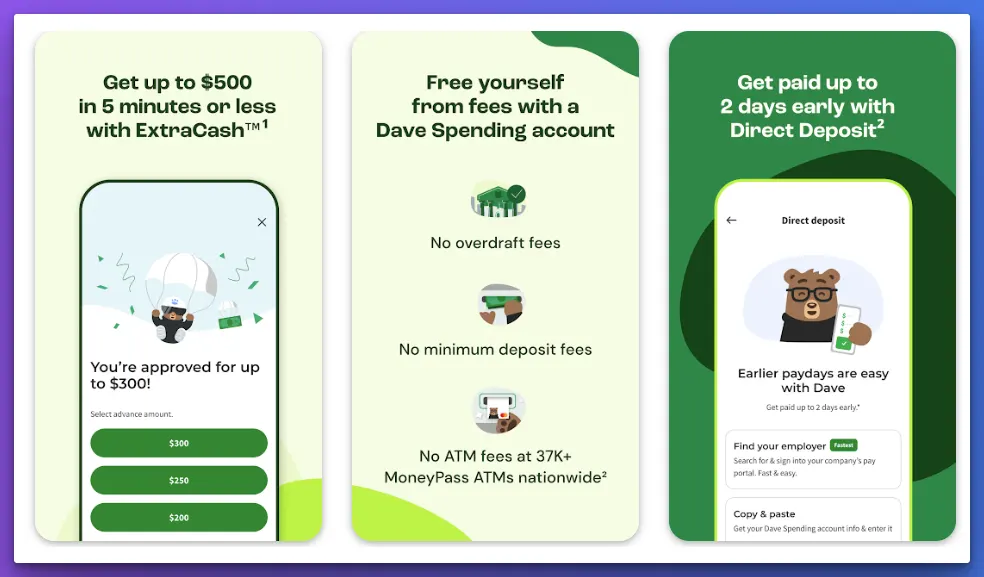

It’s true the down-payment is usually the new most significant obstacles aspiring homeowners deal with. It could be a whole lot larger hurdle for people who work in a job that does not provides a frequent spend schedule. This is why you want to begin saving once you are able to.

Begin protecting what you can every month. Such as for instance, for people who put $250 every month having one year to the a checking account you get saved up in order to $step three,000 for the next advance payment. Or deposit the difference between your homes costs as well as your ideal coming monthly mortgage payment. In that way you could start strengthening the pillow need if you’re getting used to the new monthly expense.

Really lenders want to know that you have a reliable income when it comes to whether to accept your to possess home financing. Exactly what if you have the particular business in which your own earnings ebbs and you can flows from month to month? You are not alone, many are inside class as well as concert pros, small business owners, package workers and those who do seasonal works. Don’t get worried, purchasing a home can still be in take your. One method will be to save yourself to possess a much bigger down payment which makes it possible to for the approval processes. You can also make your savings or keeps even more income provide while the a back-up plan whether your earnings from the primary performs falls abruptly.

7 strategies to buying a house for the first time

From the spark out-of a concept on the time you turn the key to cashadvancecompass.com short term loans bad credit your home, this is how commit regarding the delivering a mortgage:

- Pre-qualification: This is a good initial step to obtain a general tip from what size mortgage you can buy. Its particularly ideal for those people who are just browsing. To obtain pre-qualified your talk with an interest rate officer and you may express your own money, however, you are not collecting files so far. Indeed, you could prequalify on the web.

- Pre-approval: This task takes a much deeper consider your financial background than just pre-certification. Dependent on your bank, you happen to be requested to add documentation of income, possessions and you can expense, along with a credit check. The time has come to learn your credit score and to look at simply how much personal debt you currently keep. Depending on your position, you may have to has an excellent co-signer having a stable earnings and you will a good credit score history. In the bottom you’ll have a page away from a loan provider claiming you likely will score a certain home loan, and will create a positive change to property supplier. (Note: Pre-recognition is none an obligation to acquire nor in order to give.)

- Family search: Forgo the urge to get belongings until you recognize how most of that loan you qualify for. Once you have the loan count, go ahead and begin hunting.

- Document event: After you’ve decided on property making an offer, your home loan company often request you to amuse earnings and you will give other records to support your loan app. Also, you happen to be requested to fund an appraisal, that’s something the lender dates to confirm the brand new residence’s really worth aligns with the price.

- Operating and you may underwriting: Once you have taken out the mortgage, a keen underwriter assesses your application. They appear at appraisal and look to find out if truth be told there is people liens for the property to create a title lookup. However they check your a position, money, borrowing from the bank, assets and where your down-payment will come out-of. While this is going on try not to deal with people the new debt or even to make most other financial changes that could feeling the loan consult. If you get conditional recognition, the fresh underwriter might demand some more data files.

- Final acceptance: When your loan is eligible, you are happy to close. You happen to be considering an offer of your own closing costs shortly after you complete the loan application after which in advance of closure might located an ending Disclosure, otherwise Cd, towards the terms of this new contract as well as your last costs.

- Close and you may signal: With respect to the fresh homebuying procedure, closure time is the big finale a single day our home technically will get your. At closing, bring your photos ID and you can good cashier’s check for the newest off percentage or arrange for a cable tv import. Immediately following signing multiple data files, you may be given your tactics!

Create your mortgage loan administrator the ally

Don’t believe you must figure all this from your individual, both. Their mortgage loan manager will be your guide throughout the whole procedure, providing choices for real estate agents, developers, family inspectors and you may homeowner’s insurance agencies.

Definitely make the most of the sense. Capable tell you and this loans to look at, ideas on how to structure them as well as how a lot of a deposit you want. Above all else, cannot exclude property you might pick prior to consulting with your own mortgage administrator.

If you find yourself willing to find out more about mortgage loans, our company is right here to greatly help. Reach out to a mortgage loan manager to discuss your role over the telephone, thru current email address or within a department.