A HUD house is nothing more than a home which had been bought with a keen FHA financing who has just like the fallen for the foreclosure

(I am not sure why these residential property are not titled FHA property foreclosure, which will become more intuitive for homebuyers and you will traders, although Company away from Construction and Urban Invention [HUD] is the federal work environment which takes biggest obligation for FHA and you will its lenders moved completely wrong.)

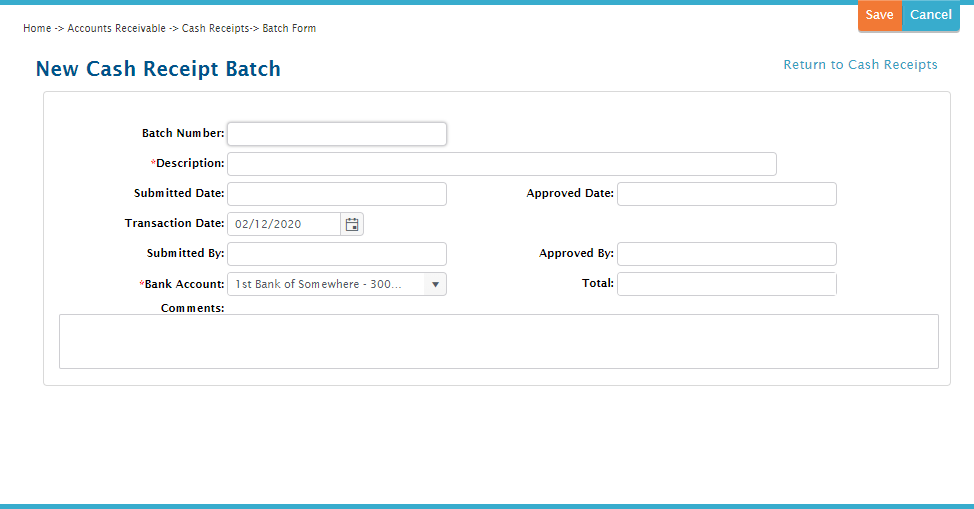

This is your agent’s obligation to check on the website to find out if your own quote is accepted in order to complete all necessary records

To get good HUD residence is distinctive from to buy a different foreclosed property. For 1, HUD homes can be bought exclusively on the web from inside the a market techniques known while the an enthusiastic promote period.

You may make an internet provide into the offer several months. At the end of the deal months, most of the has the benefit of is opened and said to be acquired while doing so. The best acceptable web bid is then accepted, in addition to buyer’s representative are contacted.

In the event your household isn’t really available in the first provide months, buyers can get fill out a bid people day’s the newest times, and additionally sundays and you may vacations. Offers try unwrapped 24 hours later.

Everything you probably have no idea is when no one tends to make a deal to have an effective HUD domestic in this some date, HUD lowers the price. The cost of the latest HUD home will continue to shed up until an enthusiastic provide is established and recognized.

Companies such PEMCO Ltd. was lead contractors with the regulators. It list and sell these land online away from HUD. Simply agents that registered with HUD could possibly get show people and you may buyers on purchase of such characteristics.

Here had previously been an alternate webpages a variety of aspects of the nation, but it’s been consolidated towards you to website: hudhomestore.

How do you browse this site and find best domestic to get https://paydayloanalabama.com/decatur/? Pursue this type of five tricks for to invest in a beneficial HUD home:

- Find the appropriate agent. Main auctions who will be entered with HUD can get show home buyers and you may people about purchase of HUD belongings online. But simply just like the a real estate agent is inserted that have HUD does not always mean they are likely to be a knowledgeable broker so you can handle your case from the acquisition of a good HUD domestic. To obtain the correct representative, you can look through the webpages that listings HUD residential property into the your neighborhood and find out which representatives depicted the quintessential winning bids. Interviews the big 2 or three representatives. Make sure to query how much time the new broker features portrayed customers and you may people, the way the processes typically works, whether or not the agent often compliment one examine the house, and you will what unique training the new broker provides gained out of writing so of many effective offers.

- Always check the house or property prior to an offer. Nearby number representative (who will be on the HUD home web site) is also gain access to the home and feature it for you. However, you don’t have to phone call the list broker observe the fresh new home with the representative. Any HUD joined broker is also gain access to a beneficial HUD family. When you find yourself examining the house or property, grab a lot of cards and you can photos of the property very you’ll be attentive to any results that need to be generated whenever creating your own provide.

- Build a deal. The offer procedure on the a great HUD residence is most likely distinctive from what you’re always. Offers would be cancelled and no earnest currency forfeiture. Just after an offer was filed, it could be cancelled up until the HUD broker opens the fresh bid digitally, otherwise immediately following from the delivering a message for the organization managing the home. Till the offer is actually closed, the fresh new serious money is perhaps not in danger, so might there be a few days pursuing the bid is accepted to help you cancel.

- Anticipate to romantic on your HUD home. At this time you might forty-five in order to 60 weeks to shut on your HUD household, but HUD try moving into 31-time deals therefore get your capital to one another beforehand. You will be capable be eligible for FHA money otherwise special FHA selling, like the $100 Down payment Added bonus program or the Good neighbor Nearby system, which gives a discount to own HUD residential property so you’re able to police, instructors, firefighters, and emergency scientific aspects just who fulfill qualifications standards. Nevertheless assists when you get the loan paperwork to each other to come of time, as well as your W-2; your salary stubs; their tax statements; duplicates of your own savings, money, and you will senior years accounts; and you may files regarding almost every other assets and you can obligations. You’ll want to give copies of your own driver’s license or any other determining pointers. Create a file for these data therefore they’ve been in a position once you was. There are also add a prequalification page to your conversion process contract in order that that it is approved. The new letter must mean the buyer was entitled to the amount of one’s package, the type of financial support and you will any assets that have been verified for closure.