In a number of affairs, you could potentially be eligible for another mortgage several ages after a foreclosures. you may have to waiting extended.

Many people with been through a foreclosures wonder in the event that might ever be able to get a home again. Credit agencies may statement foreclosure in your credit reports having 7 decades following the first skipped payment you to definitely lead to this new foreclosures, longer while you are trying to a loan to have $150,000 or maybe more.

However, both, it might take less than eight ages to acquire a different sort of mortgage once a property foreclosure. Committed you must waiting prior to getting a good new mortgage hinges on the type of loan plus monetary affairs.

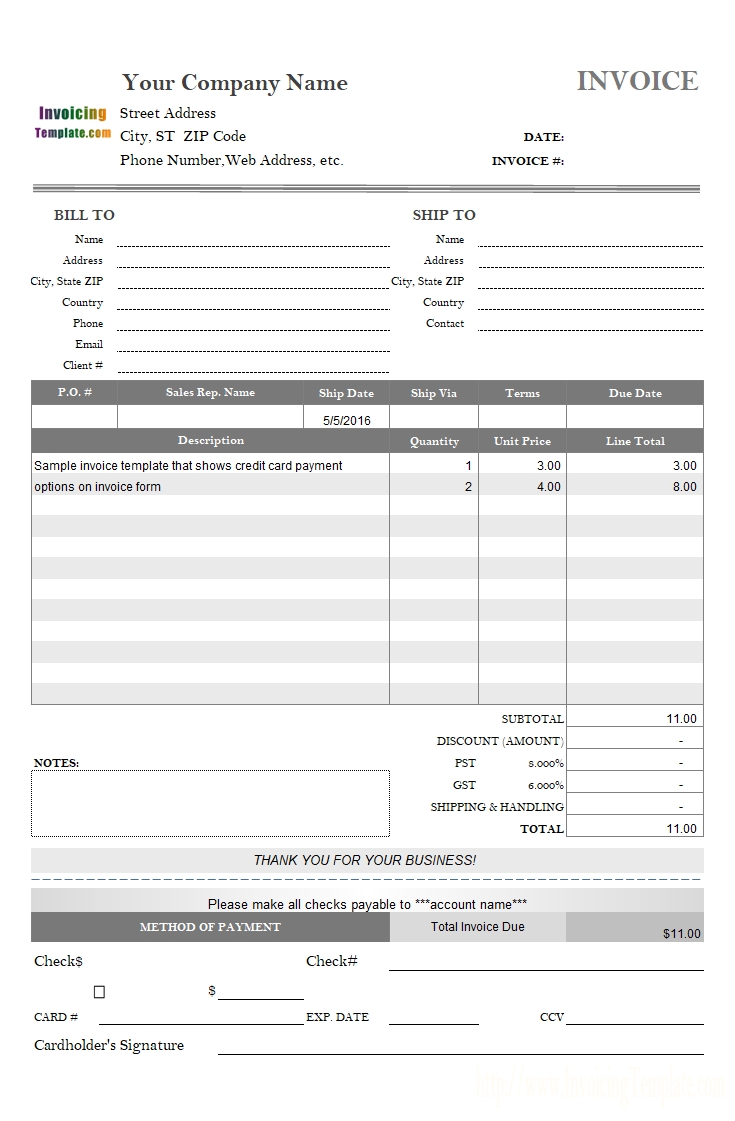

This new graph lower than shows just how long the brand new prepared period try after a property foreclosure for several categories of money, with facts below.

Plus, a foreclosure will cause a life threatening lowering of your credit scores, therefore it is more difficult to obtain another home loan. Exactly how much the score usually slip hinges on the potency of the borrowing ahead of losing your residence. Should you have expert credit in advance of a foreclosure, which is rare, the scores goes off more if you’d currently had late or missed payments, charged-of membership, or any other negative items in your own credit reports.

If you can get a loan, even after the prepared months expires, relies on how well you have rebuilt your own borrowing from the bank following foreclosures.

Waiting Months to have Fannie mae and you may Freddie Mac computer Loans Just after Foreclosure

Some mortgage loans adhere to direction that the Government Federal Home loan Relationship ( Fannie mae ) and Federal Mortgage Financial Organization ( Freddie Mac computer ) place. These types of funds, named “old-fashioned, conforming” loans, qualify to be released so you can Fannie mae otherwise Freddie Mac.

In advance of , new wishing period having an alternate financing following the a foreclosures is 5 years. Today, to qualify for a loan under Fannie mae or Freddie Mac assistance, you need to usually hold off at the least seven ages immediately after a foreclosure.

Three-12 months Wishing Months Having Extenuating Circumstances

You will be capable shorten new wishing several months to three ages, measured regarding the achievement time of your foreclosures action, to own a fannie mae or Freddie Mac computer mortgage in the event the extenuating circumstances (that’s, the right position that was nonrecurring, outside of the manage and you may contributed to a-sudden, high, and prolonged reduction in earnings otherwise a catastrophic escalation in economic obligations) caused the property foreclosure.

- show that the foreclosure is actually the consequence of extenuating things, such as divorce proceedings, disease, abrupt death of family earnings, otherwise occupations losings

- for Fannie mae, keeps a max mortgage-to-worthy of (LTV) proportion of one’s the home loan from either 90% or even the LTV ratio placed in Fannie Mae’s eligibility matrix, any type of are deeper

- to have Freddie Mac computer, possess an optimum loan-to-value (LTV)/overall LTV (TLTV)/House Guarantee Line of credit TLTV (HTLTV) proportion of one’s smaller out-of ninety% or even the restriction LTV/TLTV/HTLTV proportion towards purchase, and you will

- utilize the the fresh real estate loan to invest in a principal home. (You Florida payday loans cannot utilize the financing buying a second domestic or money spent.)

Wishing Period to have FHA-Covered Fund Just after Property foreclosure

In order to qualify for that loan your Government Property Management (FHA) makes sure, your usually need certainly to hold off at the least three years immediately after a foreclosures. The three-year time clock starts ticking in the event that property foreclosure situation is finished, usually in the go out that the house’s identity transported while the a great results of brand new foreclosure.

In the event your property foreclosure and in it an enthusiastic FHA-covered financing, the 3-year prepared period starts when FHA paid back the earlier lender to your its allege. (For folks who dump your residence to help you a foreclosures nevertheless foreclosure marketing rates cannot totally repay an FHA-insured loan, the financial institution can make a state they brand new FHA, additionally the FHA compensates the lender towards the losings.)