The Government Set-aside, the fresh new central financial of your You, comes with the country with a secure, flexible, and you will secure economic and economic climate.

- Economic Browse

- FEDS Cards

- 2017

The increased Role of Government Mortgage Bank operating system within the Money Places, Area dos: Present Styles and Potential Vehicle operators step one

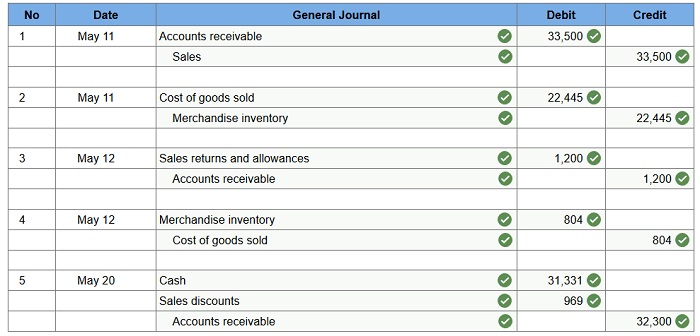

The new FHLB bodies equilibrium piece: 2000 to the current Figure 1 suggests the latest evolution of one’s combined FHLB bodies property; the new kept panel shows buck number in addition to best panel reveals fee shares. Regarding two thirds regarding FHLBs’ property are improves in order to professionals, found from inside the dark red. Along with enhances, FHLBs’ assets is securities, found into the white yellow, which are mainly mortgage-related and you can, typically, make up regarding you to-fifth of the possessions. step one However they keep certain liquid assets, in addition to in the eight.5 % of their assets during the federal financing, to meet regulatory needed contingent liquidity barrier.

The brand new leftover panel implies that inside the earliest part of the last overall economy, the FHLB program acted as a lender off second-to-final resort giving tall investment in order to FHLB professionals at a good time of major industry be concerned. FHLBs’ advances enhanced in two between 2007 and you will fall 2008, since FHLB participants found serious trouble accessing other resources of general money upon which they’d feel greatly established. FHLB system property arrived at package on the slip regarding 2008 since people visited have fun with financing provided by the fresh Treasury and you may the brand new Federal Put aside Program. Enhances have grown rather gradually given that from the 2012 and you may recently surpassed its pre-drama height.

Contour step 1: Advancement of assets

Shape dos suggests the fresh structure out of member firms’ borrowing of FHLBs anywhere between 2000 and you may 2017. For the 2000, thrifts were the main individuals out of FHLBs, however, since that time industrial financial institutions and you can insurers are very common. From inside the , credit because of the commercial financial institutions comprised over 65 % regarding full improves a great. Also, most of these advances had been expanded to higher commercial finance companies, shown in the ebony reddish. That is reasonable move in the earlier in the day: Whereas commercial finance companies having property over $50 mil taken into account below 2 per cent regarding complete enhances in 2000, the display climbed to around fifty percent towards the end away from just last year.

Profile 2: Development of advances to help you members from the variety of

Prospective motorists of the recent manner about FHLB bodies harmony layer An element of the inspiration into the newer boost in FHLB borrowing from the large banking institutions seems to be its added bonus to activate inside a good “collateral enhance” to greatly help match the requirements of Liquidity Publicity Ratio (LCR) that financial institutions are in fact at the mercy of included in the Basel III. Banking companies can be blog post reduced-liquid assets such entire mortgage loans so you can FHLBs because the collateral against enhances and use the fresh new proceeds to shop for quality water property (HQLA). For as long as FHLB advances has a remaining readiness out-of lengthened than just a month, this tactic commonly boost the borrowing from the bank banks’ LCRs. And, the favorable remedy for FHLB enhances on the LCR assists borrowing banks despite enhances due contained in this thirty days. 2 Anecdotal evidence signifies that higher financial institutions really are encouraged to use from the FHLBs ergo. step three

Shape step three compares new readiness design off FHLBs enhances (left committee) for the maturity build of their debt (best panel). While you are FHLBs do not seem to have rather altered the latest maturity construction of their enhances (new navy blue urban area to your kept has been pretty steady), the latest readiness of their personal debt has actually reduced (the fresh new ebony and you can lime elements on the right possess expanded). Into the 2006 enhances was indeed funded with a mix of quick-name dismiss cards and you may average-to-long-title bonds. FHLBs tapped small-term investment avenues in order to meet their members’ immediate investment requires throughout the newest crisis–this new hump-molded yellow and online installment loans California you may lime portions of your correct committee–however, help you to definitely small-identity financial obligation run off as the challenges alleviated in 2009 and you can very early 2010. But not, FHLB’s dependence on brief-name investment started initially to raise after this present year, and also by the end of 2016 nearly 80 per cent off liabilities got a residual maturity off below one year. The latest express out of short-label debt has already surpassed the fresh new level it hit in the drama. Considering the cousin stability of the maturity framework of FHLB’s property, meaning a serious rise in FHLBs’ readiness sales -which is, a much larger gap involving the maturity away from FHLB possessions and you may liabilities.