See capital to possess higher instructions

Playing cards bring users the main benefit of funding purchases. That it credit simplifies the process of caring for lesser family fixes otherwise a whole household reount interesting you’d shell out.

Instructions of $299 or more can be financed to own 6 months with the Family Depot Consumer credit Cards. By paying the bill within 6 months, you’ll not need to pay appeal. Specific commands could even be funded more 2 years with special advertising.

There’s absolutely no signal-upwards bonus on Family Depot Credit Cards. But not, once you join, might found:

- If you purchase $twenty-five or higher, you’ll receive $25 off

- Pick $three hundred or even more as well as have $50 off

- Spend $1,100000 or maybe more and you can found $a hundred off.

Returns is actually approved getting a stretched several months

Some affairs qualify for 30- and you may ninety-time productivity at home Depot, and others ensure it is 180-date output. The house Depot Credit Card, but not, offers a year to return commands. Your house Depot Framework Cardiovascular system offers a good 90-day come back policy to the circumstances bought there.

Mastercard Arrangement having Family Depot

Based the creditworthiness, our home Depot credit has the benefit of APRs off %, %, %, otherwise %. Late fee charges try up to $forty, as well as the cards is sold with an elegance period of twenty five days.

Limit borrowing limit of $55,100

To apply for that loan, you must earliest request the loan number, typically the www.cashadvancecompass.com/installment-loans-ut/oasis number your imagine your house restoration venture will surely cost. You might borrow up to $55,000 from Domestic Depot Enterprise Mortgage.

Creating a restoration budget is usually challenging sometimes. Requesting just what you think you would like is useful behavior. Providing you make use of borrowing into the 6-few days screen, you only are obligated to pay the total amount you invested throughout that windows.

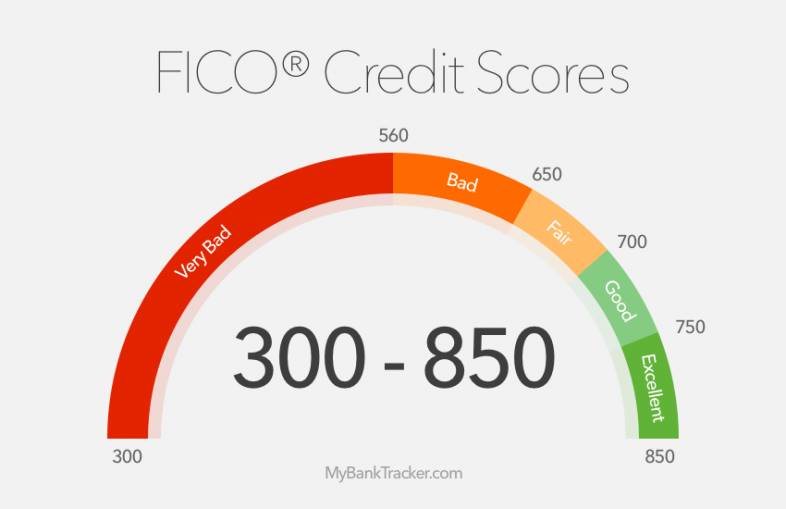

There’s no guarantee you’ll need for the house Depot Enterprise Mortgage. Having a consumer loan is essential while the approval could well be calculated generally by your credit score, the debt ratio, regardless if you own your property, and you can probably several additional factors.

There can be probably absolutely no way you’ll end up accepted to possess a giant personal line of credit if you don’t have the economic reputation to right back it.

Apart from the fresh new special deals, you will never earn benefits issues otherwise get cashback using this type of card. By using credit cards sensibly, you are better off having a cashback cards otherwise a good benefits cards rather than a store cards, until the latest advertising was anything you’re interested in. Essentially, it is similar to a line of credit for strategies. There are no perks otherwise benefits if you would like obtain up to $55,100000 to own renovations or home improvements.

How come Home Depot funds deferred repayments?

Into basic six months, certain sales would be funded at zero appeal otherwise deferred. By the end of one’s six months, just be sure to pay the balance completely. It is your decision to expend all attention into the several months whether or not there is certainly an equilibrium of 1 penny remaining at the end of brand new six months. This bank card features an annual percentage rate anywhere between % so you can %, so it might be stopped.

It would be best to apply for credit cards which have an effective 0% basic Annual percentage rate price to eliminate this problem altogether. Such bank card waives attract charges when you look at the place period, basically 12 so you can eighteen months. Following the basic months finishes, your remaining equilibrium only getting susceptible to appeal.

Loyalty System: Pro Xtra

A support system to have positives, Specialist Xtra, is out there from the Home Depot. Our members get access to personal savings, paint benefits, and you may frequency cost. The site also provides providers gadgets, eg Text2Confirm purchase authorizations and reloadable provide notes.