A debt settlement loan

Another type of alternative to a home guarantee financing to possess bad credit consumers was a debt negotiation mortgage. These financing brings together all your valuable expenses toward one commission, possibly making it simpler to manage your bank account.

In the event the credit rating is actually less than 640, you really have limited options to consolidate and refinance your existing obligations. Old-fashioned lenders normally want good credit scores and collateral in order to safe financing. Although not, there are some subprime credit lenders that provide personal loans so you can consumers which have https://elitecashadvance.com/installment-loans-ks/wichita/ bad credit score however, see you will probably keeps to spend high rates.

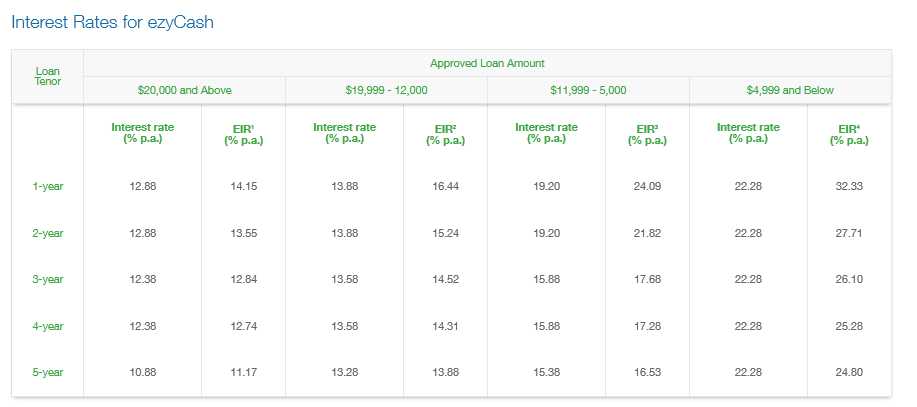

Interest levels to own debt consolidation funds may differ dependent on your creditworthiness and the bank. Predicated on economic development provide, subprime loan providers can charge interest rates out-of ten% as much as thirty-five% to mix your debts towards the one to mortgage. Repayment terminology could possibly get may include that five years, although some loan providers may offer extended fees episodes around 10 if you don’t 15 years.

Although it get clarify the debt repayments, you are able to end spending alot more during the focus over the lifetime of one’s mortgage. Make sure you comparison shop, and you can contrast prices therefore the loan amount from individuals lenders from the HouseNumbers before deciding.

Good 401(k) financing

Another alternative for people who have poor credit that happen to be unable to secure a traditional home collateral loan was being able to access their 401(k) retirement make up the fresh new required loans. Yet not, it is vital to weigh the risks and gurus before making a decision to find financing in your 401(k) because can impact your retirement discounts.

You to definitely benefit of a beneficial 401(k) financing is the fact you’ll find generally zero credit file, terrible monthly earnings criteria, or closing costs, making it an accessible selection for individuals with bad credit. At the same time, the interest rates for the 401(k) loans become lower than those towards the unsecured loans such as for example signature loans or handmade cards.

It is important to observe that 401(k) money typically have a maximum borrowing limit regarding both $fifty,000 otherwise fifty% of one’s balance, any type of are faster. This may not be sufficient to protection higher expenditures like a beneficial domestic recovery or combining established debt.

Maybe one to or many of these house collateral loan choices tend to do the job. Directly, basically needed to select one of your own significantly more than that isn’t a mortgage, I would personally make sure that I have a substantial plan to repay they straight back when I’m able to.

While looking for lenders which give property guarantee financing which have less than perfect credit, it is important to research thoroughly and you will contrast alternatives out of numerous lenders. Select loan providers which specialize in individuals which have reduced-than-primary credit and that will offer aggressive rates of interest.

It is possible to want to consider working with Home Wide variety, who can assist you in finding an educated domestic equity mortgage choices considering your personal finances and poor credit.

Finally, be patient and you can chronic in your choose a house equity financing. It might take a little while discover a loan provider who is willing to assist you in order to availableness money you should achieve your wants.

Find the best cure for open domestic equity

Disclaimer: The aforementioned is provided having informative purposes simply and cannot meet the requirements tax, offers, economic, otherwise legal counsel. All of the information found we have found to have illustrative mission merely therefore the blogger isnt and work out an advice of every types of tool over another. The viewpoints and you will feedback conveyed in this post fall into brand new journalist.

It indicates he’ll need to pay $forty,320 even more during the period of the borrowed funds term (31 season mortgage) than simply in the event that his credit is actually closely monitored and he got borrowing scores more 760. I analyzed his credit file and discovered their situation is actually highest credit use.

Family Collateral Financial investments (HEI)

Despite these downsides, an unsecured loan can nevertheless be a feasible selection for the individuals who are in need of fast access so you can cash and cannot qualify for good domestic equity mortgage having poor credit. Just make sure accomplish your pursuit and you may compare interest levels and you will words to own unsecured signature loans of additional loan providers prior to making a choice.