Getting an excellent Va loan owing to Griffin Financial support, the absolute minimum 580 credit rating is normally called for. Yet not, in many cases, consumers could possibly qualify that have a beneficial 550 credit score.

To learn more about being qualified getting an excellent Griffin Capital Virtual assistant house loan, agenda a finding name which have our mortgage officers.

Griffin Financial support offers Virtual assistant lenders getting energetic-duty military group and you can experts inside Washington, California, Tx, Florida, Georgia, The state, Idaho, Maryland, Michigan, Montana, Tennessee, Colorado, Virginia, and you can Arizona. Our very own Va Home loan Programs tend to be:

- Va Purchase Mortgage: When you yourself have got issues qualifying for a vintage home loan, a great Virtual assistant financial is a choice for choosing a separate house.

- Virtual assistant Bucks-Away Refinance mortgage: Replace your current mortgage or an excellent Virtual assistant financing with a loan who has got a reduced rate when you’re simultaneously turning security in your domestic for the bucks.

- Va Improve (IRRRL) Refinance: Refinance your existing Va financing having various other Virtual assistant financing who’s a diminished monthly payment. Having an enthusiastic IRRRL, you are able to move settlement costs and other fees towards new loan equilibrium.

All of our mortgage officials is guide you towards greatest loan product to meet your needs. All of our features are tailored toward book situation to make the application process as simple and worry-free as you are able to.

How do you Sign up for an effective Virtual assistant Mortgage?

One step in obtaining an effective Virtual assistant mortgage is securing your own COE on Va. A great COE is necessary to establish your own Virtual assistant loan qualification. Even though it might sound daunting, it portion of the process is pretty easy and could become finished in just minutes. You might submit an application for a good COE along with your bank, from the post, otherwise on the internet from eBenefits site .

If you’re there are a selection regarding loan providers who give Va household fund, Griffin Funding is dedicated to providing all of our experts having unequaled provider while the extremely advantageous terms and conditions. And you will, our very own app process has been sleek are as the productive as the you can so that you do not overlook where you can find the dreams.

Va Application for the loan Procedure

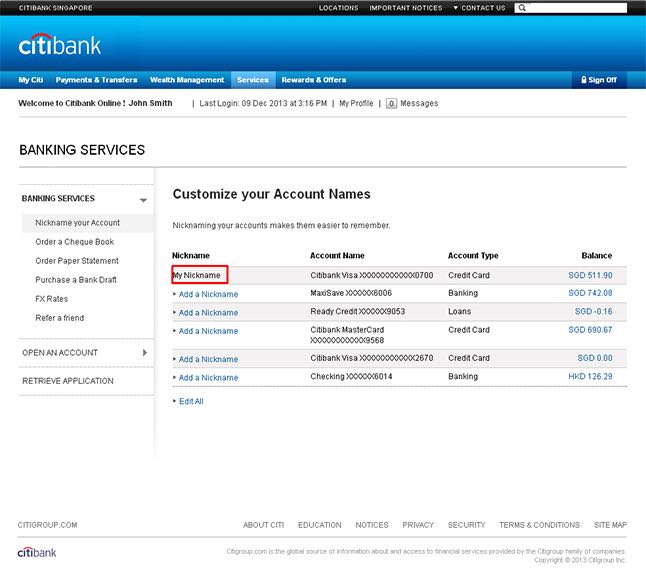

- Financing officer commonly opinion your Virtual assistant financing qualifications to choose in the event the is the right financing option for you, get the best interest rate predicated on your credit score, and loans Candlewood Knolls CT provide you with a bid and facts about your financing options.

- After you’ve the quotation, you could protect their speed based on your own conditions.

- You can either over a loan application into cellular telephone on loan officer, or you can fill out an application on line . Additionally need signal the original disclosures.

- Second, we are going to request one needed documentation which you are able to always check, fax, immediately via post, otherwise fill in for the the safer program. Understand that quicker you are able to get back the fresh new data to help you us, the more easily we can fill out it so you can underwriting.

- You will need to plan a Virtual assistant assessment that can consider the safety, hygiene, and you can architectural stability of the home. There’ll also need to be a bug assessment until the loan should be approved.

- Once things are canned, you are going to opinion a final financing records as well as have them notarized with the help of our mobile notary.

Might found your loan financial support to own a purchase to your same time. Yet not, refinance funding will need a great three-big date waiting several months.

How long Does it Try Score an excellent Virtual assistant Mortgage?

The quality going back to operating home loans regarding the home loan industry is mostly about forty to help you fifty weeks. not, on Griffin Money, we focus on performance. As such, the audience is tend to in a position to meet the requirements the customers having Virtual assistant loans inside 30 days.