Do you availability much of the latest guarantee of your property? Domestic equity ‘s the difference between your own property’s economy worthy of and what you nonetheless are obligated to pay in your newest financial. Therefore, for those who have a property appreciated at the $800,one hundred thousand and home financing equilibrium from $five hundred,000, you have got $three hundred,one hundred thousand collateral in your home.

So that is $140,100 you could utilize. Maybe you have to redesign, research full-go out, get a good sabbatical or build a zero. step 1 top seller.

Refinancing could also be a beneficial chance to combine any costs you have got such as unsecured loans, car loans and you may credit cards to the a special financial that have a lowered interest rate. You can not only reduce focus, your bank account could be better to perform according to the one cost.

If for example the new house mortgage enables you to use up to 80% of your home’s really worth ($640,000), your practical collateral are $140,100 (full security off $640,100 without any $five-hundred,000 you borrowed in your mortgage)

Simply remember that you won’t want to increase small-name costs more than 25 or three decades, so you may need to make some extra mortgage repayments so you can wipe-off one to financial obligation rapidly.

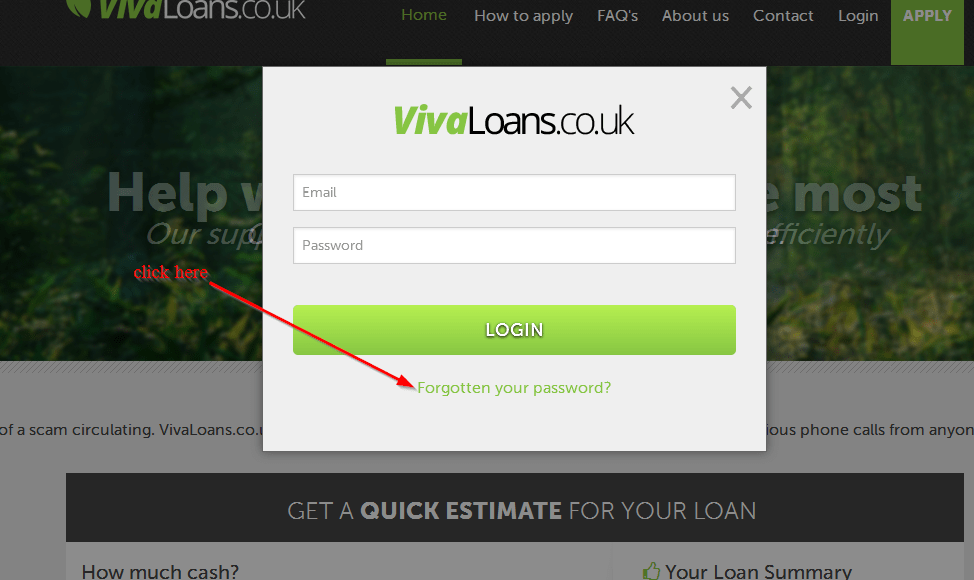

For people who bought your property a while ago, you will end up very happy to discover that the development of on the internet apps allow you to go at your own speed. Certain loan providers, for example St.George, may even offer re-finance acceptance in just weeks, depending on the borrower’s problem. They will certainly together with carry out a lot of the work for you: settle your brand-new financing and you can launch you from your own dated you to definitely by paying the bill along with your this new mortgage financing, also people costs and you can crack can cost you. They are going to even move the house label from the old loan in order to your new loan.

Prior to signing on dotted range…

- Mortgage release costs. Your existing financial might charge you a fee to release your loan.

- Repaired title break will set you back. When you have a fixed rate of interest mortgage and would like to re-finance, your current bank may possibly charges a break prices according to how long you may have left on your mortgage. Carry out the number to make certain this new savings you are able to make of the altering covers they, following particular. You can examine new T&Cs of your most recent fixed financing, otherwise your bank should be able to let you know the break will set you back.

- The new lender’s app processes you will include a lending place commission, a credit rating look at and an out in-person household assets valuer fee.

- When searching for a lesser rate of interest, remember to look at the evaluation rates regarding both fund, since it is sold with standard costs and you may fees along the life of the mortgage.

- Extending the borrowed funds name. For those who pick an extended mortgage term, your payments may be faster temporarily, but you’ll likely finish investing significantly more interest in the fresh long lasting. Have fun with our very own payment calculator to test.

- Shedding current financial have. Exactly as another type of financing device could possibly offer greatest provides, your e with your dated financing.

- Turning short-term financial obligation towards the enough time-title financial obligation. Unless you take steps to settle the amount of high-appeal obligations you have rolled into the mortgage (like that 3-season auto loan) within this a comparable label, could cause spending a lot more on the vehicles overall interest in the future.

- For many who paid back lenders home loan insurance policies (LMI) within your most recent financial (your cash loans in West End Cobb Town AL debt more than 80% of property’s well worth), odds are your own LMI isn’t transferable towards the the brand new mortgage. For example if you intend to help you re-finance more 80% of your own property’s well worth, you’ll likely have to pay LMI again together with your the newest bank.