To order a special auto is actually fascinating, but it can be overwhelming especially if it would be probably one of the most high priced possessions you have actually ever purchased.

A lot of people are reaching the part of lifestyle where these include prepared to posting their old ride so you’re able to a newer, secure or even more credible auto, however they do not have adequate coupons set-aside to decrease $20,000+ at once.

Within these issues, to order an auto with the money is among the preferred pathways somebody get. Unfortunately getting first timers, the procedure can seem complicated and leave anyone apprehensive or confused.

Marac has been providing Kiwis get on the street for much more than just 65 many years, so our company is really-qualified on auto fund processes. As such, i realized we had build a guide to lost some white about how precisely getting a car loan really works.

1. Think about your alternatives

To start with, you will need to determine whether an auto loan ‘s the best choice for you. Are you willing to afford to find the vehicle downright unlike delivering away that loan? For most people, the answer to this is certainly zero if that’s the case, have you got steady money to place into normal mortgage money during the period of 1-five years?

You will need to recognise you to when you’re vehicles finance makes it possible to buy an auto that would if not be from your own price variety, also, it is a duty and cost you will need to create over the next few years. Doing some attention in advance can help you determine whether it is suitable choice for your.

2. Determine how far you need

If you haven’t come considering vehicles, it is best to information your money or else you may end right up dropping crazy about an auto you top article can’t afford. Your regular income and you may expenditures will play a giant character in determining exactly how high priced a vehicle you’ll be able to rating.

One good way to score a feeling for how far you could manage is by using a repayment calculator, for instance the you to definitely to your ount do you consider you’ll spend to the a car to see exactly what the typical costs might be centered on your income and you can costs, do you really manage to pay for which?

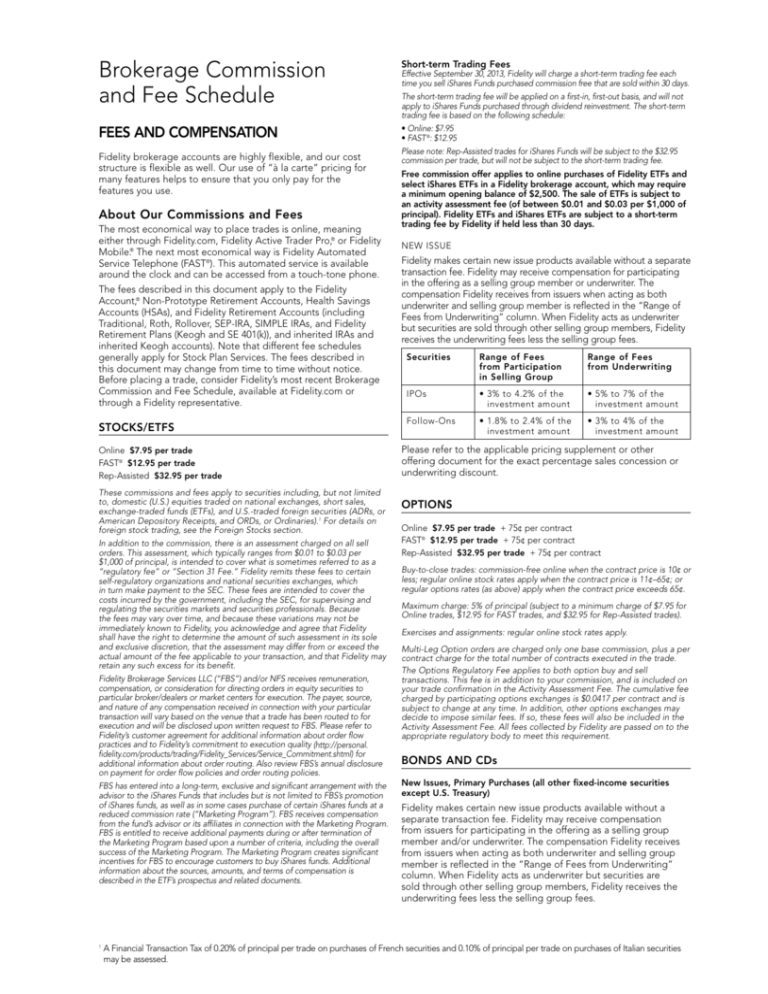

3. Lookup and you can evaluate lenders

If you’re looking an auto loan (especially if you’re in a dash), it can be enticing to deliver software directly into individuals loan providers you to definitely dont research tricky throughout the expectations one something have a tendency to stick. Yet not, trying to get several fund into the an initial space of time is also provides an unwanted influence on your credit score, thus be careful.

Instead, do a little searching in the possibilities in advance of applyingpare each other interest rates and you can charge particular loan providers may have down rates of interest but charges extortionate quantity to have business, very early money, refinancing, or discharging the automobile.

Another thing to imagine might be whether you’re to purchase individually otherwise using a dealer. To acquire an automobile due to a provider might started on a comparatively high price, however it is will a less dangerous option than simply to invest in personally, since you may be able to get back the vehicle if it is incorrect.

*An area note: if you’re to find individually, i highly recommend delivering good pre-purchase examination to make sure you know exactly what you’re to get!

When purchasing through a supplier, remember they could enjoys a popular funds spouse, and you can applying from the provider will mean the dealer may help you from techniques on the spot. That being said, perform make sure you search and you can compare the brand new financing lover’s rates, reputation and you will charges with individuals to ensure you will be selecting the lender that is right to you.