However, they are shown in the cashflow statement and reduce the owner’s equity in the statement of financial position. This guide covers the ins and outs of business expenses, including common types of expenses, what you might be able to deduct on tax, and why expense management is so important. The cost of goods sold is the cost of manufacturing or acquisition of the goods that have been sold to customers during an accounting period. It is subtracted from the sales revenue to calculate the gross profit in the income statement. Different types of cost accounting methods help businesses gain valuable insight into costs, identify areas for improvement, and make decisions to improve financial performance. It doesn’t matter how much work is being done, the number of sales you have, or how much your client list grows, fixed costs stay the same.

- Most expenses related to running your business can be offset to reduce your taxable income, and potentially minimise your tax bill.

- Expenses are generally recorded on an accrual basis, ensuring that they match up with the revenues reported in accounting periods.

- Controllable costs are expenses managers have control over and have the power to increase or decrease.

- Spends are recorded under an expense account, part of a company’s income statement.

- This method provides a more accurate picture of a business’s financial position and performance but requires more time and effort to track expenses.

- Under the accrual method, the business accountant would record the carpet cleaning expense when the company receives the service.

- Expenses are deducted from revenues to arrive at the company’s net income.

Still, good spending administration is critical to the success of any organisation. We understand that accounting can appear confusing, but everything seems to make sense once you get back to the fundamentals. Both involve analyzing and recording financial information, but they have distinct differences. Businesses can see many benefits when implementing types of expenses accounting a cost accounting system. The OCR Smart Scan automatically inputs expense reports without manual intervention, and automated policy checks and violation call-outs simplify expense tracking. Users can set up approval workflows, deviations for complex business use cases, and end-to-end GST data collection, reporting, and reconciliation.

Understanding Expenses

The purchase of an asset may be recorded as an expense if the amount paid is less than the capitalization limit used by a company. If the amount paid had been higher than the capitalization limit, then it instead would have been recorded as an asset and charged to expense at a later date, when the asset was consumed. However, failing to file https://www.bookstime.com/articles/what-is-a-pay-stub or pay taxes can result in severe penalties from the IRS such as fines and even imprisonment. Therefore, it’s crucial for businesses to stay up-to-date with their tax obligations in order to avoid any legal repercussions. Health insurance premiums for self-employed individuals can be deductible as a business expense under certain conditions.

- If you are looking to understand how our products will fit with your organisation needs, fill in the form to schedule a demo.

- Expense accounting is a crucial component of financial management for any business owner.

- Accrual accounting is based on the matching principle that ensures that accurate profits are reflected for every accounting period.

- However, failing to file or pay taxes can result in severe penalties from the IRS such as fines and even imprisonment.

- As an SEO expert focused on procurement strategies, it is important to note that managing operating expenses effectively can lead to better cost control and increased profit margins.

- When a business makes a sale on credit, there is a risk that the customer will never return the amount owed to the business.

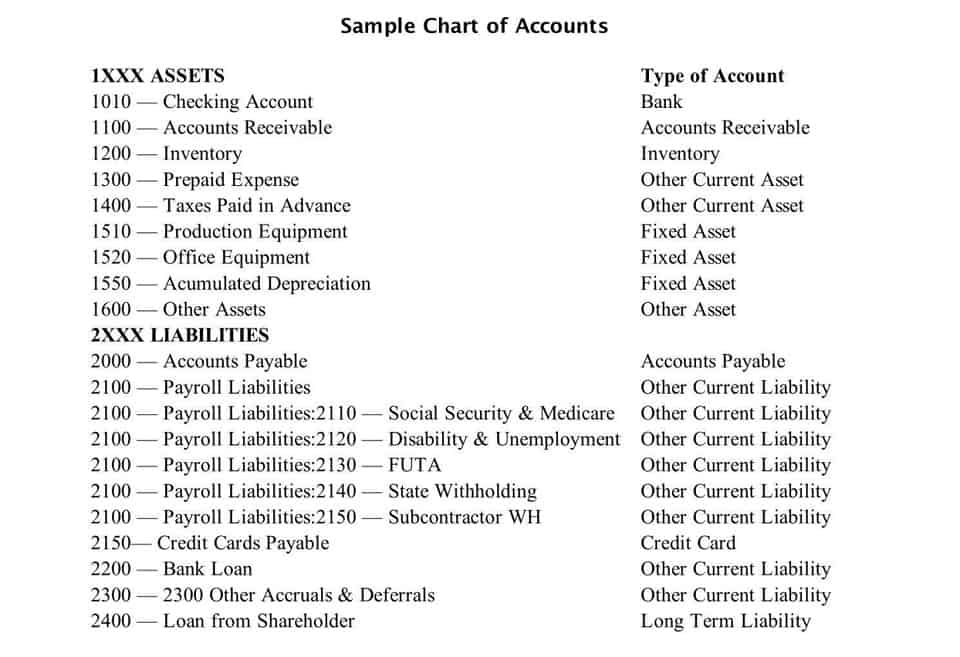

Other categories include the owner’s equity, assets, liabilities, and revenue. Expenses in double-entry bookkeeping are recorded as a debit to a specific expense account. A corresponding credit entry is made that will reduce an asset or increase a liability.

Expense: Definition, Types, and How Expenses Are Recorded

Accounting information systems (AIS) use technology to collect, track, and store financial activity for accountants to use. This system allows businesses to automate accounting and create more accurate reports. Management accounting helps make future projections and minimize risk by using pro forma financial statements, which use financial assumptions to measure and track financial information internally. If you’re looking to get more organized with your books, it’s time to start getting involved with your expense accounts. An expense is the reduction in value of an asset as it is used to generate revenue. If the underlying asset is to be used over a long period of time, the expense takes the form of depreciation, and is charged ratably over the useful life of the asset.

Any tax that is collected by a business on behalf of the IRS, such as the income tax on the salaries of employees that is deducted at source by the employers, is not treated as an expense of the business. The office building has an estimated useful life of 20 years at the end of which it is likely to be sold for $80,000. The cost of goods sold does not include any cost incurred on inventory that is unsold at the end of an accounting period, which is why it needs to be subtracted from its calculation.

Accounting for Expenses

Governmental accountants are experts in providing services that serve the government’s needs. They track project funds to ensure government programs are performing as expected and give clarity on fund spending. Public accountants are different from private accountants since private accountants work with one single organization, while public accountants work with a range of businesses and individuals. These are sub-accounts that you can expect to see in nearly every business’s expense account. In fact, breaking your expense account down into smaller accounts is suggested. Expenses are a daily occurrence in many business and accounting roles, so a potential employer would likely assume you understand expenses if you have prior work or internship experience in finance.